Rosenberg: Last time a Trudeau had a minority and NDP, the balance of power investors had no place to hide

So here’s the major thematic: more government spending, more taxes and a less friendly business climate

Article content

For the first time in forty-seven years, we have a Liberal minority government in Ottawa with the NDP holding the balance of power.

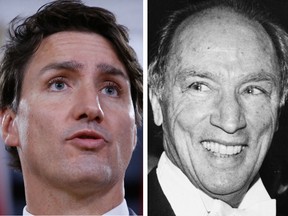

For historians, or those with long enough memories, the last time this occurred we also had a Trudeau who was running for re-election after a prior four-year majority reign and who had seen his personal popularity sag after an initial honeymoon. Not to mention, there was a Conservative leader who just didn’t have the charisma, when all was said and done.

Ultimately, the close election in October 1972 left the NDP with the balance of power and saw the Social Credit Party, as opposed to the Bloc Québécois, gain significant ground in La Belle Provence. The 1972 vote, like the one on Monday, was divided on regional lines and, as was the case then, disenchantment in the Prairies and in Alberta featured heavily.

It is difficult to assess whether the Bloc’s success has any nationalistic fervor attached to it in the current situation, but suffice it to say that four years after the 1972 hung parliament in Ottawa, we had the separatist PQ win big in Quebec. Perhaps this time around, the real separation threat will come from Alberta — and there is some support in the Wildrose Province, make no mistake.

It is unclear how Trudeau (junior) will govern with a minority, but his dad veered even more to the left in that 19-month span nearly a half century ago than he did in his first populist term. Pierre teamed up frequently on policy with the left-leaning NDP, whose leader in the early 1970s, David Lewis, was fond of calling business executives “corporate welfare bums.” Jagmeet Singh would never use such fiery language, but he does favor a ‘tax-the-rich’ policy and no shortage of other spending goodies like nationally funded dental care and student debt relief. Nice populist policies, but someone has to finance it — maybe it will simply be the bond market!

As an investor, in stocks or bonds, there was no place to hide

The Liberal Minority was elected in October 1972 and ended in May 1974, and ironically, it was the NDP that issued the non-confidence vote in the House of Commons (the Liberals cleaned up with a solid majority for the ensuing five years). And if there was a bull market, it was in pursuing a massively inflationary fiscal policy over that 19-month period.

Canadian bond yields soared more than 170 basis points as the deficit-to-GDP ratio stayed near 2 per cent, which would be the same as $60 billion at an annual rate in today’s dollars. Government spending, again relative to GDP, rose from 17 per cent to 19 per cent, and the revenue take went up by the same amount to pay for the extra public-sector largesse.

And so it was against this government-fuelled boom to economic growth — real GDP expanded at more than a 6 per cent annual rate! — that headline CPI inflation went from 4.8 per cent to 11.6 per cent while core CPI inflation almost doubled from 3.9 per cent to 7.5 per cent. It would be tempting to think that the Canadian dollar would have weakened with this type of reckless inflationary budget policy, but remember — currencies tend to strengthen on the back of accommodative fiscal policies. The Canadian dollar actually firmed 2 per cent. One reason is that the soaring bond yields attracted foreign investment into the domestic fixed-income market in droves. Surging oil prices on the back of the OPEC embargo in 1973 didn’t hurt, either.

At the same time, equity markets here didn’t like the fact that a good chunk of the incremental government spending came from taxes — as the revenue-to-GDP ratio rose from 17 per cent to 19 per cent. Nor did stock market investors like the hit to export-oriented profits from the stronger loonie (though it wasn’t called that back then). Not to mention the stiff “yield competition” that the bond market provided at the time. So in that last period of a Liberal minority government, held up by the NDP, the TSX retreated 14 per cent. And as bond yields soared, the commensurate slump in bond prices also undercut the total return in the fixed-income market.

As an investor, in stocks or bonds, there was no place to hide. But as far as Main Street was concerned, there were smiling faces everywhere. The average person (does someone with that description actually exist?) doesn’t seem to care if the paycheck is coming from activity generated from the public sector or the private sector. So long as it’s being doled out by someone. By the time the 1974 election was held, the Liberals (with the help of the NDP) managed to create an illusion of deficit-financed prosperity with 6-per-cent-plus real GDP growth. Maybe the NDP thought it would get the credit when it brought down the Liberals in the spring of 1974 — it obviously miscalculated.

So here is the major thematic. More government spending. More taxes. A less friendly business climate, especially with respect to competitive tax rates and the energy sector. Western alienation and possibly a return to Quebec nationalism. And a country’s political system marred by the fact that the party with the most votes will be looking in from the outside because this Trudeau is as far apart from his Conservative rival and just as close to his socialist NDP rival as his father was nearly a half century ago.

David Rosenberg is chief economist and strategist at Gluskin Sheff + Associates Inc. and author of the daily economic report, Breakfast with Dave.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.