Oil and refined product tankers have seen a substantial increase in demand for floating storage, sending charter rates to record levels—the result of increased OPEC production and the drastic reduction in global demand from COVID-19 sending the oil market into significant oversupply.

In a call hosted by Morgan Stanley, chief executives of tanker owners (EURN, FRO, and INSWs) noted that greater floating storage demand, increased ship loadings from Saudi Arabia, new shipping routes, and terminal delays have all been beneficial for the market.

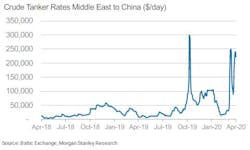

Crude tanker spot rates are north of $200,000/day, compared to the 2019 average of $40,000/day. Product tanker spot rates are above $60,000/day, compared to the 2019 average of $19,000/day.

Out of an estimated 400 million bbl in floating (offshore) storage capacity, 100 million bbl is currently utilized. Including available floating capacity, S&P Global Platts estimates 1.1 billion bbl of global oil storage is currently available. This equates to about 60 days of remaining capacity at an oversupply estimate of 18 million b/d during the second quarter as calculated by Martijn Rats, a Morgan Stanley oil strategist.

The CEOs expect that floating (offshore) storage will be increasingly in demand as onshore storage fills up. As onshore oil and product storage fills, traders have increasingly secured vessel capacity for floating storage. With much of the onshore storage expected to be filled in the near-term, an increased reliance on floating storage, largely from oil traders, is expected in the coming weeks.

The CEOs also noted increased interest in chartering vessels for longer than 6 months at about $70,000-100,000/day for the use of floating storage. Notably, Hugo De Stoop, chief executive officer of EURN, estimates a $5/bbl contango in oil prices can justify the cost of floating storage for 6 months at $50,000/day.

The panelists highlighted that demand for tankers is more linked to oil production and the magnitude of oversupply in the spot market, rather than consumption in isolation. Accordingly, the increased use of floating storage as a result of the sharply oversupplied global market has more than offset the potential negative impact associated with lower oil demand for now.

Other takeaways from the panel discussion include:

- An OPEC+ supply cut could negatively impact the tanker market, but effects may be mitigated. There is an emergency OPEC+ meeting scheduled for Thursday, Apr. 9 (initially planned for Apr. 6, but was delayed), where the group is expected to discuss potential production cuts to help balance the oil market. While panelists noted that a supply cut would be a negative for tanker demand, the market is still expected to remain relatively strong as production cuts take time to set in, and the market still likely remains oversupplied in the near-term. Based on Morgan Stanley’s analysis, supply cuts are unlikely to 'fix' near-term oversupply due to the sheer magnitude of demand loss from COVID-19.

- Tanker companies are well positioned to take advantage of strong rates, while newbuild ships may be less likely to enter the market than prior cycles. Given weakness in the charter markets through 2018 and early 2019, much of the tanker fleet remains in the spot market and available to take advantage of rising rates. FRO had around 95% of its fleet open to the spot market entering 2020, with EURN at 87% spot exposure, while INSW similarly has a majority of vessels available in the spot market. At current spot rates (relative to cash break-evens of $19,000-20,000/day), Hugo De Stoop noted the potential for EURN to generate profit greater than the company's market cap, if rates persist through the year. Contrary to historical market cyclicality, due to shipowners over-ordering newbuilds in good markets, the CEOs saw the propensity for tanker oversupply limited by a difficult financing market, a shutdown of some shipyards in Singapore, and lack of confidence in current propulsion systems amidst increasing fuel emission regulations.