Great Crashes Are a Naturally Recurring Phenomena

In his classic «The Great Crash of 1929,» the iconic economist John Kenneth Galbraith described how speculative bubbles occur time and again. Looking at current events in the financial markets, his conclusions are just as relevant today as they were then.

In his classic «The Great Crash of 1929», written in 1954, John Kenneth Galbraith rhetorically answered the question if another great crash was possible.

He wrote: «No one can doubt that the American people remain susceptible to the speculative mood – to the conviction that enterprise can be attended by unlimited rewards which they, individually, were meant to share. A rising market can still bring the reality of riches. This, in turn, can draw more and more people to participate.»

Reading the book, there are many similarities with the Roaring Twenties to today’s markets. Back in 1927, in response to a European economic hiccup, the U.S. Federal Reserve reduced the discount rate and bought a large amount of Treasury bonds allowing the bond sellers to reinvest the proceeds into the stock and bond market.

Sounds similar to what has been happening here.

The major source of new funds for stocks in the late 1920’s was a tiny 10% margin requirement to buy stocks. The amounts of money borrowed from banks all around the world to fund U.S. stock purchases grew dramatically in 1928 and 1929.

When the market broke down and margin calls went out, it was not just investors who were wiped out, but also many banks.

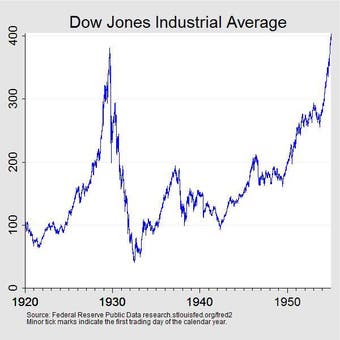

The Dow peaked on September 3, 1929, closing at 381.17. The index declined until July 8, 1932, when it closed at $41.22. The index did not reach the 1929 high again until November 23, 1954.

Today, nimble gamblers can buy various cryptos on small amounts of equity using margin, options and other gambling instruments.

Over the past couple of years, in addition to global central banks printing many trillions of dollar equivalents, the U.S. government has given away trillions of newly printed dollars as «Covid» relief. No surprise that these supported record inflows in the markets by investors.

In a foreword to the 1997 edition, Galbraith wrote:

«That we are having a major speculative splurge as this is written is obvious to anyone not captured by vacuous optimism. There is now more money flowing into the stock market than there is intelligence to guide it […] There is a basic and recurrent process. It comes with rising prices, whether of stocks, real estate, works of art or anything else.» (to which I today would add crypto currencies)

«This increase attracts attention and buyers which produces the further effect of even higher prices. Expectations are thus justified by the very action that sends prices up.»

The end result of every such boom is a bust that wipes out the excesses.

Galbraith in the book summarizes previous bubbles going back to the 1637 Dutch tulip mania. In the U.S. there was some mania every 20 to 30 years that ended in a bust. Good economic times create a surge in asset prices. Optimism etc. take prices to unrealistic levels and then the common end is a bust that wipes out most of the investors late to the boom.

Obviously, this is what is happening now. A robust recovery from the Covid bust, hastened by huge amounts of newly printed money, has pushed up asset prices across the board. Again, record inflows from individuals into stocks, bonds, real estate, and crypto nonsense demonstrate that prices are getting ready to bust out.

As I have written regularly, global government money printing has created rising asset prices. More money chasing relatively fewer assets creates higher asset prices.

However, it now seems that governments will stop creating new money – assuming no new Covid money giveaways, we are heading into an environment where less money will be chasing more assets.

More assets chasing less money is called a bear market.

Charles Biderman