Most Americans understandably have tunnel vision when it comes to the American CPI and what it might portend for their personal circumstances. Gasoline prices and those for anyone trying to buy a car or now rent some kind of shelter, the threat is immediate. From this palpable sense, the word “transitory” today might just seem offensive.

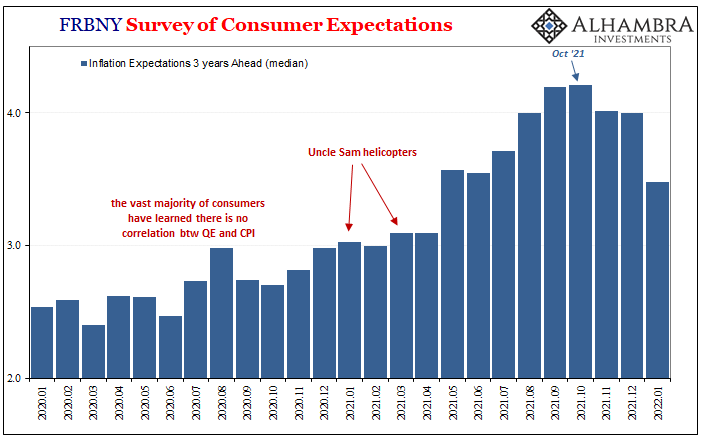

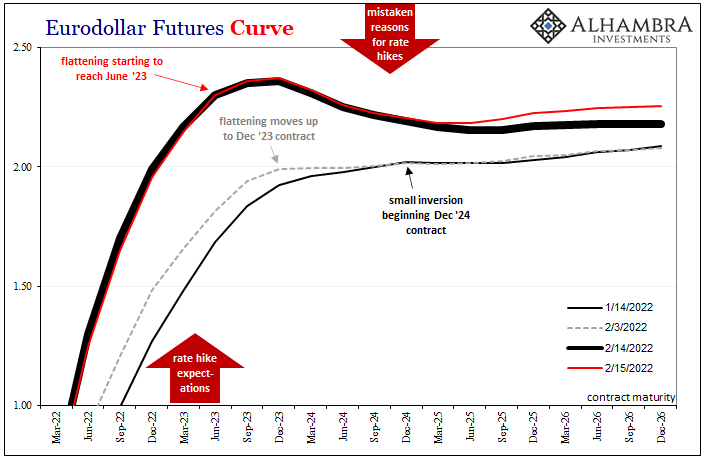

Yet, it may prove itself anyway. As discussed earlier in the week, not all Americans are laser-focused on the current price at the pump or what highly leveraged CRE investors are extrapolating as ongoing rental hikes forever forward. Inflation expectations, those measured by the Federal Reserve’s very own New York branch, have taken a step back.

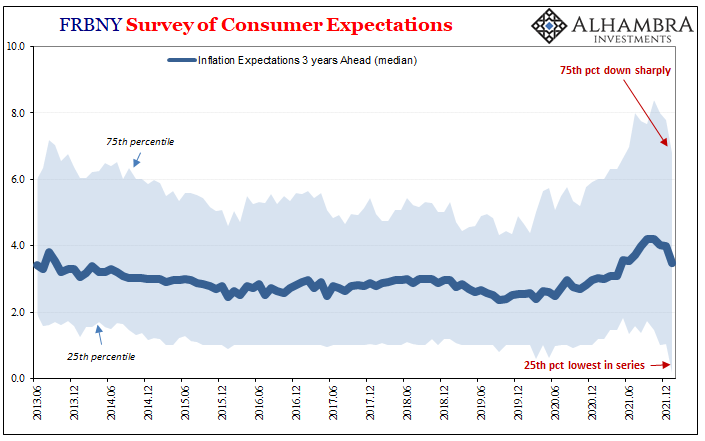

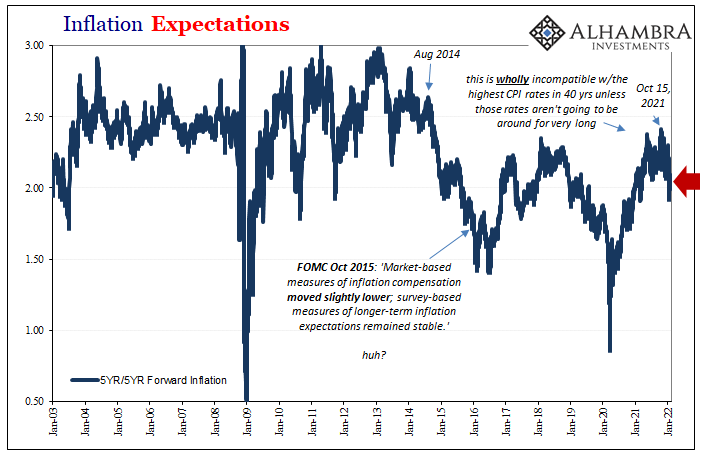

Those directing toward the longer run have diverged even farther.

“Something” changed in them around last October.

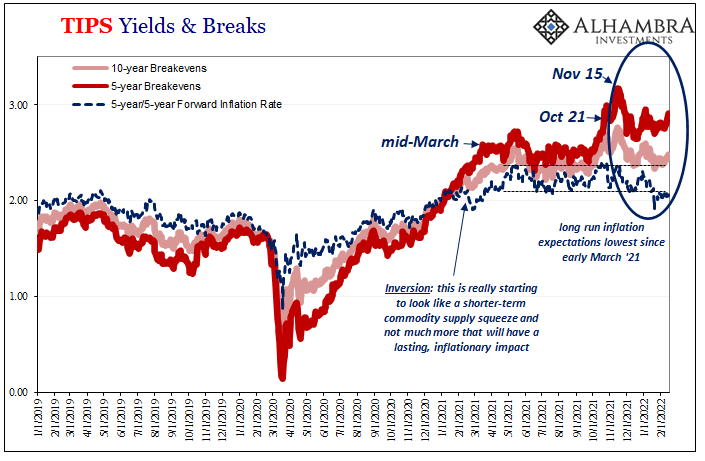

These results mimic what we see in the TIPS marketplace, too. From these, they only begin a compelling “inflation” story moving hurriedly in the transitory direction apparently away from the US CPI and the common narrative surrounding it (and the Fed’s looming rate hikes you’re led to believe will put a stop to the “nightmare”).

Whoever is being surveyed into the bottom run of FRBNY’s ranges, they like TIPS investors seem to be more in sync with global factors. Something tipped the scales months ago, an inflection which has been repeated in many places outside the US.

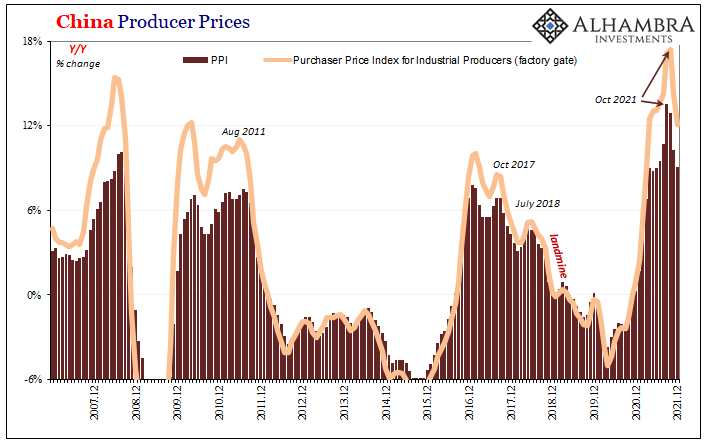

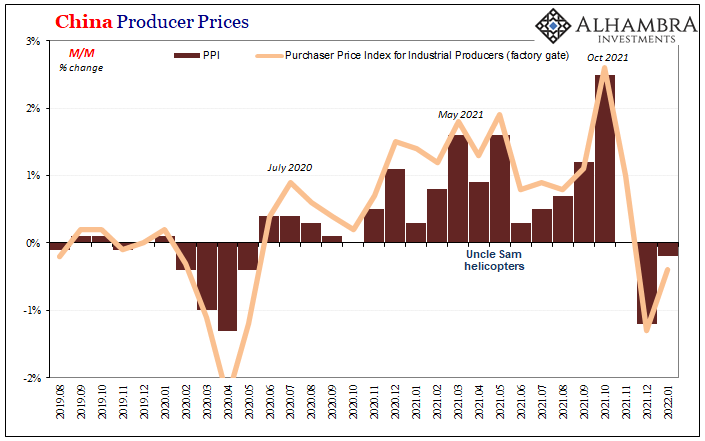

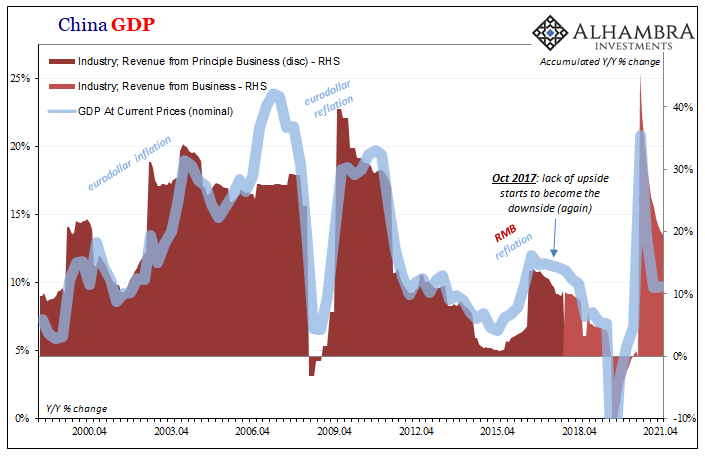

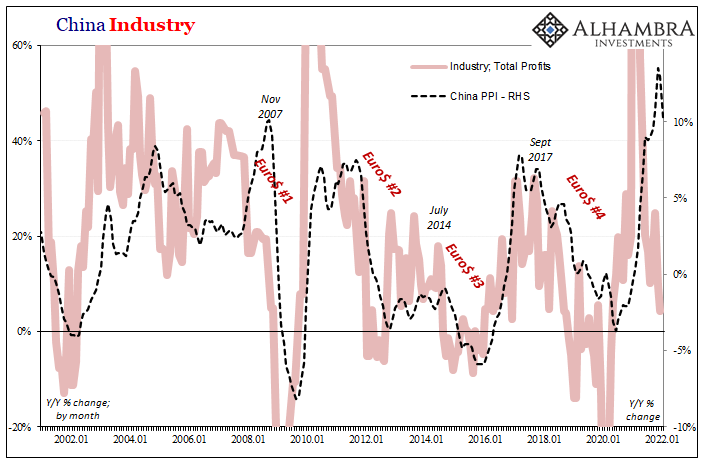

A big one has been China, particularly producer and factory prices. Each of these have subsided substantially since, sure enough, also October.

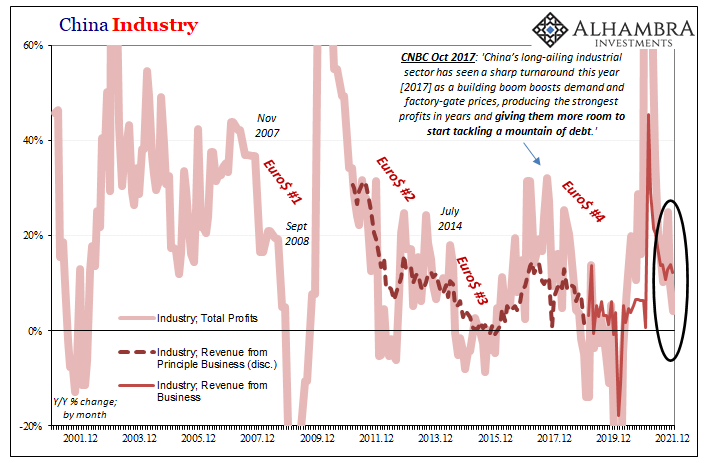

To some, this is proof of successful Communist central planning. Chinese authorities had been vowing to crack down on every possible source of commodity and producer price “inflation”; from its NFSRA auctioning 50,000 tons of aluminum, 30,000 tons of zinc, and 20,000 ton of copper last July to the Ministry of Industry and Information Technology chastising “speculators” while promising to crack down hard on “hoarding.”

Have these combined efforts succeeded?

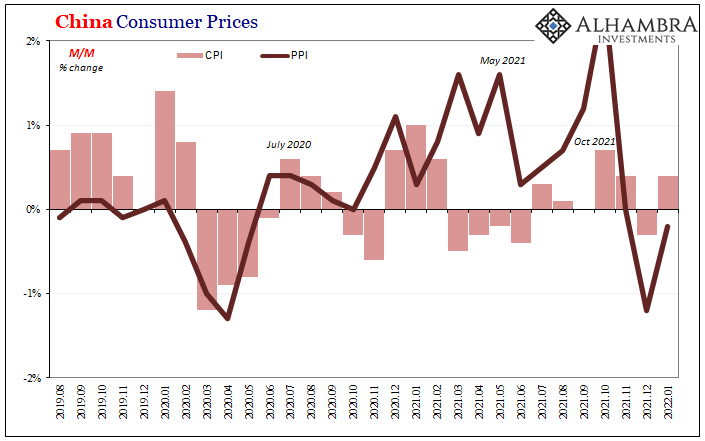

According to China’s NBS, consumer like producer prices decelerated yet again in January 2022. The Chinese CPI rose just 0.9% year-over-year, down from a peak of 2.3% in November.

Those for producers have weakened for three months running; from no change (month-over-month) in November before a big drop in December followed by another, smaller decline in the latest price data for January. Both China’s PPI as well as its index for factory gate prices have almost certainly topped out (see: above).

Do we link TIPS investors and FRBNY’s survey of consumers to Communist efforts to stamp out commodities last summer? No. Far more likely, it is the global economy beginning to show itself as in at least slowing down from early 2021’s artificially-inspired blowoff (which, in volume terms, wasn’t much of one).

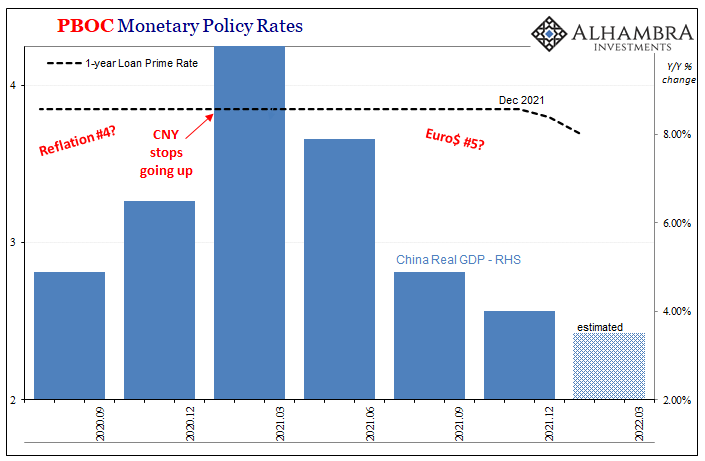

As to the Chinese end of it, a broad survey of its economic data leaves little doubt as to the macro relationship regardless of governmental factors. China’s PBOC didn’t “shock” the world with rate cuts (LPR, RRR, MLF) in December before following them up with another round last month because an otherwise healthy recovery was rescued from producer price anomalies.

The PBOC cut those rates for the same reason(s) it had cut them during the inflection stages of prior slowdowns (Euro$ #n’s).

We’ll find out this weekend if monetary authorities feel another drop in the LPR is warranted – and not because declining PPI and factory gate numbers signal better circumstances ahead.

You can see this in everything from Chinese GDP to industrial revenues and especially profit growth in that sector which has sunk since, surprise, surprise, October. The rate of increase for them had been relatively good, up around 20% y/y rates, before decelerating sharply in November (+9.6%) and then barely positive in December (+4.2%); the same months China’s PPI began to drop.

In an unhealthy economy, China as well as globally, supply shock-driven prices are eventually going to lead to “transitory” as producers, in particular, have to absorb input costs unable to pass them along to consumers.

This only adds more negative pressures to that slowdown.

American consumers have been able to take on some of those costs far more than elsewhere, but even here there’s been a clear limit (payrolls and labor participation) despite the inflation narrative surrounding the unemployment rate.

It’s the same “growth scare” that rather than disappear only continues to gain evidence and support from these various undercurrents. Not just here or there, all over. It may not be mainstream in the US given the CPI’s behavior, yet the sentiment and concern is more than nibbling around the edges of inflation expectations (in whatever format), the divergence growing across-the-board.

For China, it’s not just inflation expectations anymore, their inflation numbers are on their way down already.

October.

As a reminder, the Chinese economy has proven time and again to be a leading indicator.

Stay In Touch