In the seventeenth episode of the second season of the Comedy Central cartoon South Park, the show introduces one of its longest lasting memes that has survived despite the first airing being nearly twenty years ago, and all the vulgarity and seemingly gratuitous violence in between. Titled Gnomes, we find one of the main character’s underpants (seriously) being stolen by small gnomes who feel compelled to do so. When finally confronted, they explain that it is central to their three part plan:

The entire episode was contained within the usual countercultural paradigm that the show so often seeks out; in this case it was the WalMart-phobia of the 1990’s where especially small towns would rise up against the invasion of the big box retailers (in this case it was a parody of Starbucks) who everyone knew put mom and pop out of business. Depicted often as heartless corporations, the South Park version is a defense of where capitalism inevitably goes; just as family farms were lost in the industrial progress of the 19th century, so were the mom and pop retail shops of the late 20th.

The gnomes were business geniuses who just couldn’t explain why (as shown above), representing the hidden hand of capitalism in which individual actors often aren’t entirely sure exactly how they are successful – they just are. The 3-part plan for the gnomes has morphed into different meanings, however, starting in the attempted reconstruction of what had gone wrong in the dot-com era. The media and culture itself seized upon the setup as an explanation for dot-com companies whose “business plan” was similarly vague if non-existent in the all-important middle.

And so the underpants gnome has been used as shorthand for crackpot schemes, those with often high-minded ideals to start with, high-minded anticipated results as the expected outcomes, and absolutely nothing in between to plan or demonstrate a working knowledge as to how one becomes the other. It is so often the failing of “great” things because they fail to explain the “how’s” and “what’s” that makes this theme so devastatingly effective all these years later.

Staying faithful to the original message, it works in the general marketplace because the marketplace is broad, perhaps stretching toward infinity; for every gnome’s business plan that will fail there may be one who will succeed, and neither might know exactly why for each. Many dot-coms failed, but many did not; the problem was balance and proportion, factors that were thrown out of whack by circumstances unrelated to capitalism – but everything to do with what was really and actually going on in the middle of money.

In the 1980’s, the Federal Reserve had decided that economists had learned sufficiently from the grave, global mistakes of the Great Inflation such that they would compensate for the evolution of money by controlling just a single interest rate. Ben Bernanke himself has acknowledged the age of “missing money” if only to suggest how in the end it was by his convention all so easily overcome (he gave the speech in 2006, after all, meaning he wasn’t yet privy to the fact it was premature celebration, blinded as he was by infatuation with his own stunted reasoning). It was, essentially, an underpants gnome schematic:

1. Target federal funds rate

2. …

3. Control Economy

If you research monetary theory over the years, that is exactly what you find. Policymakers didn’t want to know how it worked, just that it seemed to and therefore they assumed it would work forever in time. It is an especially stupid paradigm to believe in not just because of the complexity of even a small economy, but especially one like that of the US which doesn’t ever stand still. As the economy was built, torn down, rebuilt, torn down, and rebuilt again, so too was the monetary system.

To target the federal funds rate in actual operation means to use the Open Market Desk of the New York Branch to buy and sell bonds from the inventories of Primary Dealers. But even this most basic task is itself a more complicated aggregate of smaller inputs; the Open Market Desk doesn’t make snap minute-by-minute decisions of what to buy or sell, it’s activities are set as derived from calculated anticipation for what banks will do in each maintenance period (14-day windows for where banks must hold specific levels of required reserves) about what it shall do and how it shall do them. The Desk had operated each business morning by contracting trades at pre-determined prices so as to match the level of reserves its calculations project would be necessary to maintain the federal funds policy target rate.

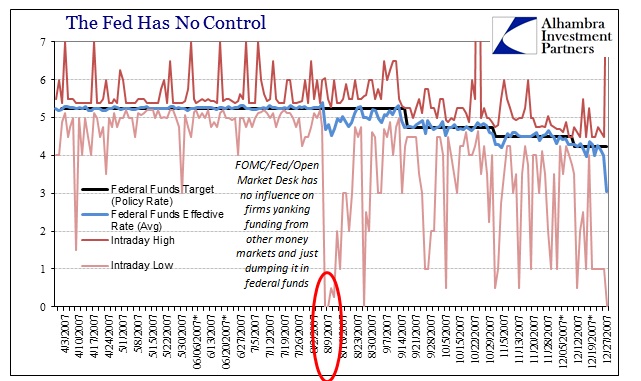

But the federal funds rate itself is not the comprehensive reality of the federal funds market; it is an aggregated weighted average of trades that are conducted at various rates at various times during the day. It had become quite common, in fact, for the federal funds rate to drop well below the target rate later each business day afternoon because the Fed had developed no mechanism for the messiness of actual operation.

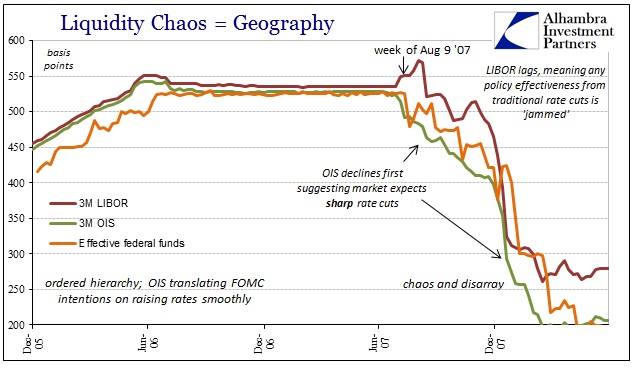

In the end, what monetary policy presupposes is that its efforts will simply average out to what it wants. Before August 2007, there was very little if any opportunity to challenge that assumption largely because it was believed that if the Fed wanted it could make the market do that target rate; therefore the market did little else but that target rate with only relatively minor, irrelevant (to overall market conduct) variances intraday. Starting August 9, 2007, really August 10, all that changed in what was really a “prove it” situation.

Even though the FOMC had set a specific target rate, federal funds had on August 10 fell sharply below, with some unknown quantity of “liquidity” being offered and accepted at 0.0% despite what was supposed to be a policy anchor of 5.25%. This deviation persisted, largely later in each trading day, not only in August 2007 but also at some of the worst times of that period (including September and October 2008).

In addition to that problem, the Open Market Desk had several others to contend with. At the high side, there were some trades going off in federal funds above the Primary Credit “ceiling”, one that had been established by switching the Discount Window, having been reduced a week later as the very first “emergency policy” measure in what would become a long line of nothing but failure. It was originally an alarmingly high federal funds rate that on August 9 initiated a much larger-than-normal Desk response on the morning of August 10 that surely contributed to the rate then coming in too low. As the transcript for the full FOMC emergency conference call on the 10th records:

CHAIRMAN BERNANKE. Good morning, everybody. As you know, financial markets have been fragile. They appeared to continue to be quite fragile overnight. There are difficulties with commercial paper funding and other short-term funding and a lot of concerns about counterparty risk. This morning the Desk, responding to a situation with the federal funds rate trading well above the target, did a large early operation and announced that to the markets. They are prepared to come back throughout the day to continue providing reserves as needed to keep the federal funds rate at our target.

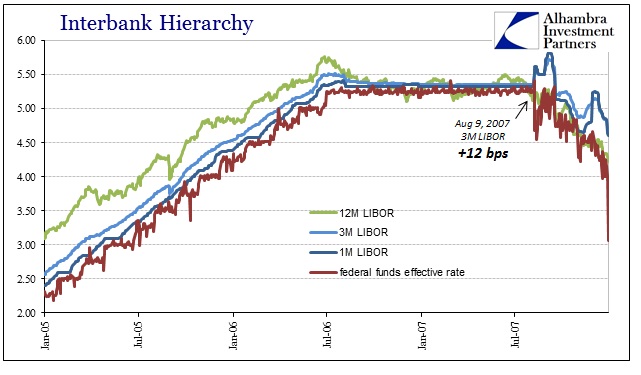

But as the FOMC was talking about aiding a federal funds market that started to shallow, LIBOR rates did and maintained the opposite; meaning that dollar funding, really “dollar”, was not reaching the vital offshore spaces. The Fed was not unaware of this problem, as Bill Dudley explained at the regular September 2007 FOMC meeting:

First, the turmoil in money markets did impair the functioning of the foreign exchange swap market. This made it more difficult for banks in Europe that are structurally short of dollars to obtain the dollar funding needed to fund their assets.

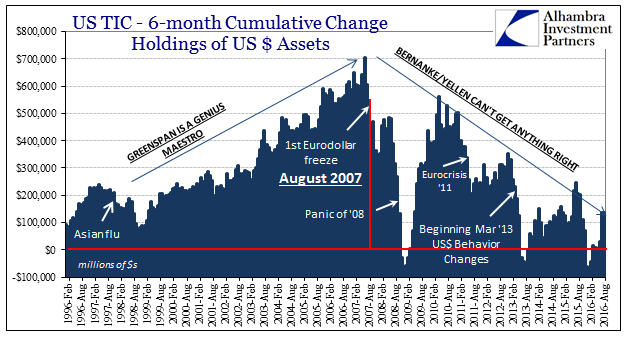

At this early stage, the FOMC decided that its response via federal funds alone (including what it thought would be a bold and effective 50 bps cut in the target approved at that September meeting) would be sufficient “reassurance” as to liquidity so that its “accommodations” would be broadly shared, and at least the target for short-term rates would be maintained. It was sheer folly because it presumed that federal funds would always be widely available as governed by the strict hierarchies that had dominated money market operations for decades – hierarchies that the economists of the Fed had shown little or no interest in understanding. What had really happened was a geographical divide in operation where offshore “dollar” markets were increasingly (and disruptively) deprived of them (in all kinds, eurodollar deposits to FX swaps) while NYC would remain largely oversupplied especially at the most crucial moments. It defied all forms of the monetary policy’s sense of itself.

But those were not the ends of the Fed’s problems, only the tip of the ice berg. At the same time, commodity prices were exploding, especially oil, as debt prices were collapsing from the riskiest mortgages (suddenly and relatedly appreciated as such) but ominously not ending with them. Then on top of that, there was the repo market increasingly deprived of collateral that related to everything else but indeterminate as far as how the Fed could even theoretically respond. The Fed could not even maintain its federal funds target and then transmit its intentions, let alone abilities, to global “dollar” markets, so how would it have acted had it been under a different target mandate?

In other words, what if the Fed had been operating upon a gold price target or as a blended commodity target mandate? At that point in 2007, and again at the worst points in 2008, there were contradictory signals from all over the place – LIBOR rates screamed out for more liquidity, federal funds for less; repo for collateral not “reserves”; commodity prices indicated badly needed “tightening”, while debt markets from commercial paper to the more esoteric MBS structures blurted desperate warnings. What would a commodity target faced with these contradictions (as well as others I haven’t included; those where the real fun begins) have accomplished? Would it have meant the Fed further depriving markets of “liquidity” just as certain parts of these markets needed them the most?

You cannot answer that a commodity target would have prevented these circumstances in the first place because this is not an exercise in theory; it is the intended development of solutions for the world as it actually is. We have at this moment a credit-based, global virtual currency system that does not stand still, where just these kinds of contradictions are normal (at least since August 2007) as well as global. You cannot just assume that a new target regime will easily overlay a more basic one that has already proved far beyond the reach of such naiveté.

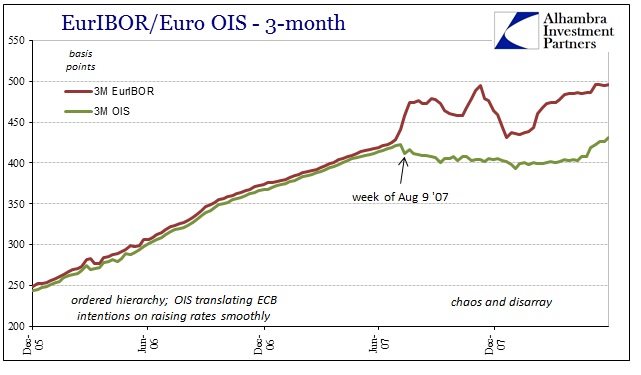

This was not just a problem for the Federal Reserve, of course; the European Central Bank found itself with the same target deficiencies also starting on August 9, 2007.

In fact, the paradigm blew open so far that in the more than nine years since that day, Eonia has yet to rest upon its pre-crisis normal target above the MRO main policy rate.

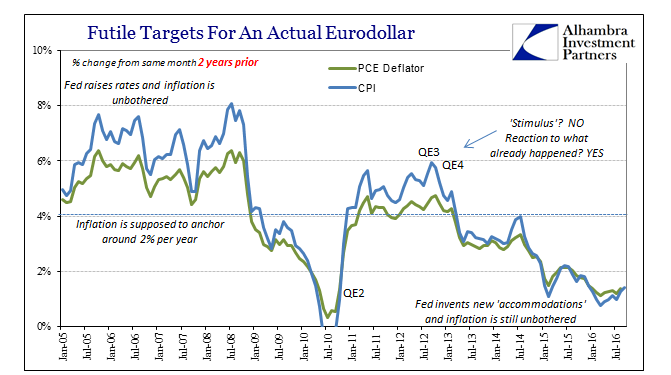

If central banks who once believed that a single rate could control broad economic function cannot even meet the unbelievably low standard of actually enforcing the most basic type of all potential policy target candidates, why is it just presumed that central banks will be able to meet other more complex targets? The answer is simple, because most people still rely on the myth of what the Fed can supposedly do if it wanted rather than the reality of what it cannot do when confronted with conditions marginally outside its theoretical boundaries. Believing central banks as all-powerful or even something just resembling that is clinging to disproved theory. It is the underpants gnome solution to an unstable “dollar” system that was created, evolved, and enlarged specifically because there was this blackhole of knowledge, the shadows where all was assumed rather than verified until it was much too late.

It’s not as if the Fed hadn’t had warning, either. As I have noted many times in the past, in June 2003 the FOMC discussed the very real possibility that interest rate targeting was all a canard – it only “worked” because it appeared to have worked, and when it doesn’t, as in Japan, there is very real trouble. That is why Bernanke should have been far less self-assured when he recalled “missing money” in 2006; there is a great deal in Step 2 of the gnomes’ template that centralized systems cannot just leave to unexamined mystery. Any target regime right at its outset must rely upon technical competence; that is the last thing perfectly evident of central bankers right now and for a very long time before now.

If we are to relieve the global economy’s “dollar” suffering, it cannot be to some other “target” approach without specifically answering what is in the middle. It is not enough to even start the conversation which would rely on disproved legend, that the Fed can if it wanted simply conjure “liquidity” sufficient to maintain whatever new mandate for stability.

How much “liquidity” is required to keep the dollar such that oil or gold prices move only in a narrow range? In what form? If we are talking about oil, does that mean the WTI curve or Brent? Should the Fed target steep backwardization on the futures curve? How steep? Or, when confronted with contango, as has been the case for the past two years, should the Fed offer “liquidity” in basis swaps such that curve decompresses but only at the shorter end? Against what currency? What happens if that liquidity is transmitted such that it depresses instead interest rate swap prices against long-dated Chinese yuan swaptions? You get my point; to propose a new target regime for monetary policy no matter how truly noble its purpose and intent must first answer #2:

1. Target gold, or commodities

2. …

3. Stable dollar

Unfortunately, this is the reality we are confronted with; it is not enough to simply wish it all away and think about how that might work in an ideal system or in a vacuum. We have the system we have, and it cannot just be scrapped by the wave of an imperial hand such that we have a clean state from which to rebuild anew. If A doesn’t work, as it surely doesn’t, and B is clearly superior, as it surely is, then we still have to consider, perhaps only consider, how B would work starting from A.

The Fed already proved that complexities defeated the simplest monetary target regime there is; and it’s not as if we haven’t seen the other side of this with RHINO (rate hike in name only). The Fed raised only once the federal funds rate last year and eurodollar futures and the UST curve responded in the opposite direction, while LIBOR and repo moved up and kept going. The ECB to this day continues to prove it can’t actually target much if anything (including what passes for a rate “floor”; a negative deposit rate that instead of pushing “reserves” into action has seen only hundreds of billions of € pile up no matter how negative the “floor”). Why should we expect that a more esoteric and far more complex target will just work?

An actual money market, however, does because of the truth of Adam Smith hidden within the underpants gnome schematic. From a broad, decentralized base, solutions can be found, determined and implemented even if we don’t know how or where they come from (think quasi-money that from time to time appears when money is short and central banks show again their vast limitations). From a narrow, centralized base, if it doesn’t work there aren’t any solutions; 2008 showed there aren’t even any other ideas. In whatever comes next, it should be free of any targets, whether interest rates, inflation, commodity prices, or, the worst, least-defined (in terms of all the “how’s”) idea of them all – NGDP targeting.

The real world is unbelievably complex and dynamic; all targets presume that such complexity can be overridden by static simplicity. Even Bretton Woods barely lasted a decade and a half because of modernity.

Stay In Touch