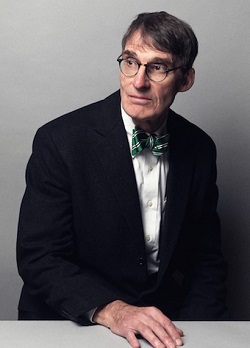

Erik: Joining me next on the program is Jim Grant. Famously, the editor of Grant’s Interest Rate Observer, one of the best-known publications on Wall Street.

Erik: Joining me next on the program is Jim Grant. Famously, the editor of Grant’s Interest Rate Observer, one of the best-known publications on Wall Street.

Jim, I have so much been looking forward – ever since we launched this podcast two years ago with Jim Rogers, actually, as our first guest – I’ve been looking forward to getting you on the program. And, frankly, I’m glad it took this long because I don’t think there’s ever been a more important time in the last ten years to be very closely observing interest rates.

Before we get to interest rates, though, I want to start with a higher-level question. A new Fed Chair, Jay Powell, is running the show.

What is your expectation? Is Jay Powell a good pick to replace Janet Yellen? Do you think that we’re going to see a change in policy from the Powell Fed as opposed to the Yellen Fed? And what’s your overall reaction to the state of the Fed, so to speak?

Jim: Well, Jay Powell has one commanding credential. And that credential is the absence of a PhD in economics on his resume. I say this because we have been under the thumb of the Doctors of Economics who have been conducting a policy of academic improv. They have set rates according to models which have been all too fallible. They lack of historical knowledge and, indeed, they lack the humility that comes from having been in markets and having been knocked around by Mr. Market (who you know is a very tough hombre).

Jay Powell at least has worked in private equity. He knows a little bit about the business of buying low and selling high. Also he’s a native English speaker. If you listen to him, he speaks in everyday colloquial American English, unlike some of his predecessors. So I’m hopeful. But not so hopeful as to expect a radical departure from the policies we have seen.

Erik: Let’s go ahead and carry that forward to Treasury yields then. Because, obviously, this is the topic on everybody’s mind. We’ve seen this backing up in rates. And there’s every imaginable theory from this means inflation is coming… to this is a reflection of Powell being more hawkish, and it’s all about Powell… to this is about President Trump’s policies and deficit spending.

What do you think is driving this backing up of interest rates? And where do you see it going from here?

Jim: I’m a little bit more fatalistic. You know, we have come to accept that financial markets are driven by people and by policies and by personalities. And, what is Chairman Powell going to do? What will President Trump tweet next? As if they were in charge.

Well perhaps sometimes they are not in charge. I have observed over the years that the bond markets have tended to move in generation-length cycles. Anywhere from 20 years to 35 years. This is not an ironclad law of physics, but it is an observation from the middle of the 19th century forward.

So we have concluded (perhaps) the bull market in bonds that began in 1981 and that maybe ended in the early days of July 2016 (I think). So it might just be that interest rates are going up because they are going up. It sounds a little bit mysterious and indeed fatalistic, but I’m a little bit less inclined than others to assign causation to people and policies.

Erik: Now, the last time we were at a secular low in yields was in the 1940s. And it took a full decade –

Jim: I remember it very well, Erik. I was there. I was born in July of 1946, so I missed the first three months of the bear market. But my mother told me about it. She said it was fabulous.

Erik: But it took – even though you were born only three months into that – it took ten years before there was a meaningful rise in interest rates. Does that mean that it’s going to take ten years before we see a meaningful rise? Or is the meaningful rise already upon us?

And how far can it go? What stops it? What breaks if things get too far?

Jim: 1946 to 1956. Ten years. Rates went up about ten basis points a year. One tenth of a percentage point a year. Very, very slow and deliberate. Now, I think – not know, mind you – I think the tempo will be rather more brisk.

I say this because there’s more leverage in the system, because there’s more debt around. Although one could argue that the debt is going to constitute a damper on things. I happen to think the debt will, in fact, become a problem that will lead to higher rates. That is another guess rather than a piece of knowledge.

So I’m looking for a bear market in bonds having begun in July of 2016. I think it’s upon us. And I think the tempo will be brisk enough to notice.

Erik: Jim, you were on the cable networks last week and mentioned that the timetable could probably be different because risk parity might speed things up. What’s the mechanism of operation there? How does it come into play?

And I guess the other part of the question is; what would be the limits of how far this can go? Some people have said rates can only go so far before the stock market crashes or something. Do you think there’s a limit as to how far rates can back up? And what would that limit be?

Jim: First, risk parity, as you know, is based on the proposition that bonds are inherently less risk-fraught and less volatile than equities. To someone who was around in the ‘60s and ‘70s and ‘80s, that proposition is somewhat contestable. But that’s the idea.

So if stocks are inherently riskier, what you want is to equilibrate risk, so they say. You want to have a parity of risk in the portfolio. And to do this you lever up the bonds. You get more bonds, having financed the increment with borrowed money. And that increment of bonds is going to equilibrate risk with equities, the stocks.

All right, that’s the theory.

Now that may work in a gently trending market. It has not worked at certain times and junctures in which both stocks and bonds decline together. So my sense is that there’s a lot of money in risk parity and that a forceful rise in interest rates, a steep decline in bond prices, is going to force liquidation of some part of the risk parity portfolios.

Now, Erik, you wonder how far it can go. People, I think, are arguing that it would be inexpedient if rates went a lot higher. They say impossible. What then actually mean is inconvenient.

I forget now exactly what the size of the interest expense of the public debt is, about $400 billion. The government is paying 2.2 or something on its debt. Doubling of yields to 4-something and doubling of gross interest expense to $800 billion or so would certainly be an inconvenience. It would require very painful political choices. But, no, it is not impossible.

So I think that, yeah, the stock market is going to run into trouble. It’s richly valued. But I don’t look for Armageddon. I look for higher rates, and I look for appropriately lower price-earnings multiples. And I look for a much higher interest bill on the part of the US Treasury.

Erik: Now, one of the staple theories of macroeconomics is that, supposedly, as Treasury yields go up – especially relative to what sovereigns in other countries are offering – that attracts international capital. And the currency appreciates at the same time.

We’re seeing this backing up in rates coincident with weakness in the US Dollar Index. Normally that’s emerging market stuff. It’s not supposed to happen in developed economies. What’s the explanation for that? And can it continue?

Jim: It can certainly continue. Things do. I guess that people would perhaps be looking at real rates of interest rather than nominal ones. Perhaps the learned people in the bond market would be saying: In its history over the past 50 years, the average real interest rate, the average real yield, on the ten-year US Treasury is on the order of 2.1% or so (I think).

Nowadays, if the rate of inflation is 2%, and the yield on the ten-year is approximately 2.9% – that’s less than one percentage point of real yield. Now ,that’s before tax. It’s not exactly a king’s ransom.

So perhaps people are saying: Yes, nominal rates have risen. They may rise some more. But it’s not such a great bargain.

On the contrary, one might say – well, to be sure, it’s not a bargain. But they’ll look at Europe where rates are considerably lower and the creditworthiness of some of the sovereign issuance is considerably more dubious.

So, Erik, I do not have an explanation why the Treasury is out of favor with the world’s bond speculators. It has happened before. Perhaps – I don’t know – perhaps they read Twitter. All sorts of reasons.

Erik: One of the things that your answer brought to mind, you mentioned this might be about real rates versus nominal rates. For several years now, deflation has been the backdrop. And everybody says nothing else is possible. It’s almost as if people have forgotten that inflation is a real phenomenon.

Is it coming back? Is it on the horizon? Is it nearby? Or are we still likely to see continuing deflationary pressure in the economy for the next year or two?

Jim: Well, Erik, I happen to be in the inflation camp. I’m most humbly placed there. There are powerful arguments on both sides of the question. But something to bear in mind is that nobody issues a press release at the start of an inflationary cycle. It kind of creeps in on little cat’s feet.

The 1960s are a case in point. In the early ‘60s there were four consecutive years – 1961 to 1962, ‘63, early ‘64 – in those years the measured rate of inflation in the CPI was, if memory serves, less than 2%. In fact in some years it was less than 1%.

Parenthetically, nobody thought that was a problem. That seemed like a good thing. But it was the high noon of Keynesian fine-tuning and the economists thought they had the system figured out.

There was a great sense of triumphalism in the councils of the president’s economic advisory committees. But then, lo and behold, comes the Vietnam War, comes the demographic, comes the coming of age of the baby boomers, comes all sorts of things which in retrospect appear to have been instigators of the price inflation. But they were not so regarded at the time.

What had been a period of utter quiescence in prices suddenly became a period of creeping inflation. In fact, that creeping inflation had crept in the ‘50s and early ‘60s. Some people decried even a 1% or 2% inflation rate. But by the mid-’60s inflation was running at 3% and 4%. And we were launched into the ‘70s.

What relevance does this have today? Well the relevance is that you really don’t know. So, when I think about inflation, I think mostly about the risk/reward proposition of the bond market. We can’t really predict these big cosmic cycles.

We can observe what is in front of us and how people are positioning themselves. And what I observe is a lot of muscle memory. A lot of looking backwards. A lot of fitting the present-day news into the template of the Irving Fisher debt deflation model of the fussing over the weight of encumbrance on the world’s economies.

I’m in the inflation camp. I think it’s coming. I have thought this for a while. People have looked all over for it as if looking for a lost sock or a hairpin: Where did it go? Where is that thing? But I do believe that the central bankers who have been kind of begging for inflation will be surprised at the generosity of the inflation gods over what they will ultimately be handed.

Erik: Now, you are in the inflation camp, which, under normal circumstances, would probably make you bullish on gold. But, at the same time, you’ve said that this dollar weakness trend could easily continue – which would normally be bearish gold.

Where does that leave you? Is it time to wait for the dollar to play out? Or is this a good time to be buying gold?

Jim: By way of confession and truth to podcast – let’s see, I confessed I was born in 1946 and that makes me, like, 37? Okay, I was born in 1946 and I was bullish on gold in 1945. I hope that puts my view on this into context.

I’m chronically, sometimes profitably, but certainly very nearly continuously, well-disposed to the legacy monetary asset. I think that so many arrows point to it in the present day. I think it will become the beneficiary of – I’m talking about gold now – gold will become the beneficiary of so many trends. From the tinkering and the unprecedented experimentation of our central bankers’ fiscal profligacy – I’m starting to sound moralistic –

I think that paper money is in a secular bear market and that the institution of managed currency will be seen to be a species of pretense, if not outright intellectual fraud. And I use that word advisedly. And I think that come the dropping of the scales from the eyes of the money holders of the world, gold will do better against almost every currency.

Erik: I want to come back to something you said earlier where you described if Treasury yields were to double that would obviously double the government’s cost of debt service. And the cost of debt service was about the same as it is now, ten years ago. But it was half as much debt. So with twice as much debt, if we go back to ten-years-ago Treasury yields, we would double the cost.

It surprises me, Jim. I get a lot of guests on the program who say: Oh, don’t worry about it, they can always print more money. The US government borrows at its own currency, so it’s not a problem.

I just don’t understand that view, because it seems to me if that were to happen – sure, they could go to outright monetization, fire up the printing presses and use it to service the debt – that, presumably, would have an effect on markets that would be reflexive and cause people to maybe panic.

So what do you think it would look like?

Let’s suppose that rates continue to back up and we move towards that doubling over the next few years of Treasury rates? That, presumably, creates a budget crisis for the US government.

What options do they have in order to respond to something like that? And how would you see it playing out?

Jim: This is one of these problems that will confront us when it confronts us. I’m not spending much time thinking about that now.

I would contest a little bit, Erik, the idea that we have not been monetizing the debt. The Fed, of course, has been monetized. It’s buying federal securities with credit that did not exist before the Fed tapped the relevant numbers on its computer keypad. The Fed has come to own substantial portions both of mortgage-backed securities and of Treasuries securities outstandings.

By definition, that is monetization. It has turned those pieces of paper – or those digital images – into living credit.

Erik: That brings me to another question. Which is – I’ve thought quite a lot about this –people don’t seem to question that US Treasuries are just always the safest possible investment on Earth. Why they’ve always thought that and favored them over gold has always been a mystery to me.

But, frankly, it seems to me that at some point – I don’t know what the point is – but you have to reach a level of debt where at some point it becomes impossible to ever repay that debt in real terms. You could always repay it in nominal terms, because you can print more money.

But if you get to the point where it cannot be repaid in real terms, where it becomes a guarantee when you buy a US Treasury bond that you will never get your purchasing power back – you may get positive yield in nominal terms, but you’re always going to get a negative yield in real terms because the debt has gotten to such a level that they can’t possibly service it in real terms.

Doesn’t that eventually lead to some aha moment where the market says: Hey, wait a minute, the whole argument against gold and in favor of Treasuries was gold doesn’t return anything. Gold doesn’t lose anything either. It doesn’t have a negative real yield.

Jim: Erik, you have just described the ‘60s and the ‘70s and the early ‘80s. A moment ago you observed that some people feel that Treasuries are inherently safe. I would say that there ain’t no “inherent” in any asset class. It’s all a question of price and value.

If you go back to the late ‘60s into the ‘70s, into the ‘80s, ending at about 1985-86, what you find is the very commonly held view that Treasuries are inherently unsafe. Leon Cooperman, I think, was the fellow who coined the slogan that “Treasuries are certificates of confiscation.” That is that they guaranteed you a loss.

This was at a time when the inflation rate was doving – it was running close to double digits. And Treasury yields were not so much higher than those double digits. So everything you asked about with respect to a crisis of the future has in fact occurred in the past. And it was resolved before these difficulties.

They were resolved by a fellow named Paul Adolph Volcker who, by constricting the growth in bank reserves of bonds – which ended on the 30th day of September 1981 when the Treasury 30-year bond touched intraday 15%. That was how the cycle ended.

It didn’t end all at once. There were retests of those lows in prices and highs in yields. But we got through it surprisingly well.

This next cycle is not going to be identical to the last. I don’t think that there is anything like Armageddon ahead of us. I think there is a realization that the monetary regime of the past four or five decades is wanting, both in intellectual rigor and it will be seen that it is lacking in operational success. It’s not seen now.

So I think that, yes, there will be an aha moment. People will say: Can’t we do better? And I think we will do better. But, for now, people are mainly unquestioning about our system of currencies. They mainly don’t think to ask what money is.

A bond is a promise to pay money, right? And what is money? What is money? Years ago when QE just started, there was a letter to the editor of The Financial Times. And the author of this letter said: At long last I have now understood the meaning of the term “quantitative easing.” I now understand that. What I no longer understand is the meaning of the word “money.”

I so loved that letter, and I so have been waiting for others to raise that very question. But the question still is mostly tabled. It is unasked. And I think that what you are asking, Erik, is when will a proper quorum of investors ask the question: What is money?

And to that question I say: I haven’t got a clue.

Erik: Now this massive, massive accumulation of debt in the United States – people like you and I can say this is crazy, the rate that it’s happening at – but, holy cow, look at China. I mean, they’re in a whole different category of rate of accumulation of national debt. It seems to me like they’re trying to almost race the United States to who can get more over-indebted faster.

Jim: They’ve won. There’s no contest.

Erik: What can be the outcome of this massive credit expansion?

Jim: I’m going to describe it not in terms of national debt. I’m going to describe it in terms of bank credit. As of the end of 2017, Chinese commercial banks showed assets of $40 trillion. That’s with a “t” as in “Tom.” $40 trillion.

And that works out to a little more than 50% of total world GDP. For this there is no precedent on Earth. For perspective, at the end of last year the US commercial banking assets were about $17 trillion – in the context of a $19 trillion US economy. That’s $17 trillion in commercial bank assets and a $19 trillion economy.

To go back to China, $40 trillion on the banks’ balance sheets and the economy is something like $13 trillion in China. This is a stupefying and astonishing, literally fantastic state of affairs in China. They have reinvented the sense of what’s possible.

I think it was 2016, maybe, when the Chinese expanded banking assets by 16.5%. If a single bank was expanding at that rate, you’d fear for its solvency because you would have a proper suspicion of the credit protocols and lending offices – how could they lend that fast? And to whom? And to what end?

But the Chinese have been growing at such breakneck speeds, so this debt has been in the service of all manner of infrastructure and real estate and – the asset bubbles have been equally stupendous.

In the current issue of Grant’s we have in the headline of the front pages today “Xi Jinping’s Poisoned Chalice.” This is the Xi Jinping (whose name I think I am butchering in pronunciation) is of course the new president for life. And our sense is that one-term presidencies in China are better than two terms, and that better than either would be emigration. So we think that Xi Jinping is the president for life in the wrong country.

It’s just amazing what is happening in China. And I think that it represents a clear and present danger to everyone with money at risk. Not just the Chinese. Not just the real estate markets in countries favored by the Chinese, such as Australia. Not just in the industrial metals markets – China has been kind of 100% of the demand for the margin for steel and the like. But this debt thing is a very, very important low-hanging dark cloud over the world, and we have all gotten used to it.

At Grant’s, we’ve been decrying these Chinese lending and borrowing practices for years, with no real payoff yet. But we think now is not the time to accept it as normal. It ain’t normal.

Erik: Jim, nothing lasts forever. 100 years ago, if you’d asked somebody, they would have said that the British pound sterling is the world’s reserve currency forever, because it can never change. And of course now they say it’s the dollar forever. It will never change.

It can’t possibly be forever. Some people think that maybe the end of the dollar’s regime as the world reserve currency and having hegemony over the global financial system might be starting to come to an end.

China of course with their petro-yuan oil contract seems to be trying to encourage oil trade not to occur in US dollars. We see the petrodollar system in general starting to break down as Iran has outlawed US dollars for exchange of their oil. Venezuela is trying to move away from the dollar.

Are these things really starting to point to maybe the end is close for the US dollar? And, if so, what would the consequences and knock-on effects be that investors should be thinking about?

Jim: The dollar is the Coca Cola of world monetary brands. And, in its day, the British pound was the Earl Grey tea of monetary brands. Well-entrenched, and there was no reason to suspect that it would not be the perpetual favorite.

Lo and behold, the British Empire came into its sunset years. But observe that the pound remained an important reserve currency into the 1950s, notwithstanding the loss of British financial and military power.

The US dollar: It was on the outs in the ‘70s. And I remember people, including myself, speculating that the world was tiring of this reserve currency and that the dollar would be supplanted by something like gold. It was not supplanted.

There, perhaps, ought not to be a reserve currency. But we do have one. It’s the dollar. And I don’t look for any quick change in that fact.

Erik: Jim, let’s move on to junk bonds. Forgive my ignorance. It seems to me like the whole theory is junk bonds are worth less because you might not get paid back. Yet, European junk bond indices were actually yielding less than US Treasuries at one point. And I think you recently had written something about particular issues in Europe.

How is this even possible? That junk bonds are being bid up in price to be supposedly safer than US Treasuries? How could that be?

Jim: Well, I think the answer to that question takes the form of two words: Mario Draghi. There is a very strong bid in Europe from the European Central Bank for securities of all kinds.

We at Grant’s have made a major – a major – financial discovery. We have discovered a junk bond in Europe – denominated in Euros of course – that has a zero handle. You’ve heard of junk bonds beginning with the numbers two and three? Those seem very low indeed.

But we have found one that begins with the number zero. And that is in a Telecom Italia – I think it’s a five-and-a-quarters of 2022 that the yield to maturity (which is the same as the yield to worst) is, like, zero point eight.

Now that – that is not a high-yield security. It’s a strong junk rating, but still at speculative grade and, at this price, to yield less than 1%. Now that is the ocular evidence. That is the visual manifestation of the destruction of price discovery in Europe. That is on the European Central Bank.

I think it is one of the great scandals of the present day.

Now, in response, I think that Mr. Draghi would say that he had to do this because it was that or the end of the Euro. But, my goodness, interest rates are the most – I say, as the editor of Grant’s Interest Rate Observer – interest rates are the most important prices in capitalism.

And prices are better discovered than administered, certainly better discovered than repressed. And the incidence of these abnormal, aberrant, and even funny yields in Europe is evidence of something gone very wrong indeed.

Erik: That begs a very important question in my mind. Which is, really what you’re telling us is these yields are being repressed by a man who has a printing press, and therefore is not subject to the limitations of normal mortals like you and me.

Does that mean it’s not time to short this stuff yet? Because the bid could get even stronger? I can’t imagine European junk bonds going negative yield. When do you short this stuff? Is it now?

Jim: Wait, Erik. Why not? One is 80 basis points away from it. A lot of corporate debt – maybe my information is not up to the minute – but a considerable segment of the corporate debt in Mario Draghi’s portfolio is yielding just about nothing, or less than nothing, in nominal terms.

So anything is possible in this regime of financial suppression – repression – depression. Whatever it is.

Erik: Does that mean the opportunity is ripe to short these things now? Or does it mean that we need to wait until there is a change of policy in the ECB?

Jim: This is not my topic. I write about this stuff for a living. I have become quite reluctant to advise the professionals in speculation what they ought to do.

It would seem as if the risk/reward proposition in front of a potential short seller of some Euro-denominated securities is very favorable. The risk to the upside in price of a speculative-grade security quoted at less than 1% – that risk would seem to be minimal.

But I leave it to those who do it for a living to decide whether it’s time.

Erik: Jim, I want to move back to what probably is the biggest question on everybody’s mind, which is the really big cycles. As you said, maybe we’re at the end of a 35-year bond bull market.

What are the drivers of these long-term cycles? And what controls when you spend ten years at one extreme or another before the rates start to move again? And what should we expect to see next?

Jim: Well, Erik, on historical form, when one of these bond cycles gets started it just keeps going. And the rhyme and reason for it is apparent mostly in retrospect.

It might help to anchor one’s perceptions of current-day interest rates with a little bit of historical perspective. There is a page-turner of a book called A History of Interest Rates. And no doubt you have one by your bedside.

I called up the still-living co-author of it, Dick Sylla. He was a professor of financial history at NYU Stern. I said: Richard, I have read many but not every page of your magnificent narrative. Tell me, in the 5,000 year recorded history of interest rates, have there ever before been substantially negative nominal bond yields. Not Treasury bill yields, mind you, but bond yields.

And Dick thought for a second and he said: No.

So a 5,000-year first. This was as of July of 2016. I think there was something like $11 trillion worth of sovereign debt priced to yield less than nothing.

There was a paper that came out of the Bank of England a couple of months ago, and a very important – to me at least – observation. Which was that, as of early July 2016, the ten-year Treasury, quoted as it was, at 1.36 or something was the low. This was the lowest reading ever recorded on a global benchmark sovereign ten-ish-year yield.

And that goes back to the 1300s.

So we are looking at a truly epical low in the summer of 2016. This is not to say that it definitively will prove to be the low – I think it will be – but we are looking at coming off a low that was literally unprecedented. And perhaps that extreme will help to set expectations for what may follow.

And the reciprocal extreme in the previous bear market was likewise so off the charts. I mean, 15% on a 30-year, 25-year non-call security – it was 14% I guess, as recently as 1984. Those were such extreme yields to the upside.

So we can look and say, yeah, they are going to be followed by reciprocally ridiculous low yields to the downside, and so they were. But we have never seen the likes of what we saw in the summer of 2016. And I think – again, one thinks, one doesn’t know – but I think this will be the backdrop for a very long cycle in rates to the upside.

Erik: Jim, as you think about, potentially, that big trend that is moving in the other direction from what we’re used to, where are the opportunities? Or where are the places that investors and speculators should be looking?

Is it at the outright trades – you, know, shorting bonds? Or is it more opportune to be looking at spreads – curve flatteners and steepeners and that sort of thing? Is it outright trades? Is it pairs trades, looking at one bond class relative to another? Say junk versus Treasury?

Or where do you think the people should be looking in order to identify trading opportunities?

Jim: Erik, so what do you do when rates rise? Well, there are money market instruments – the humblest of the humble. Warren Buffett seems to be a reluctant participant in the Treasury bill market to the tune of $100 billion or so.

You can do even better than Treasury bills if you are willing to take some credit risk. And we at Grant’s have written about so-called cushion bonds, which are relatively high-yielding corporate securities trading near their call prices, offering yields of 3.5 and 4, 5, and up.

The tradeoff is some (we think) manageable credit risk in return for an increment of interest income. And, for some people who need that extra income, we have been looking at these corporate cushion bonds.

But, perhaps – perhaps, Erik – another good place to look is in the alternative legacy monetary asset, gold, which is utterly in the shade. Owing to the popularity of cryptocurrencies, and owing to the popularity of stocks and bonds. Mining stocks are orphaned. Gold itself is very much a laggard.

You would expect that, with the dollar weakening and with the world giving the stink eye to the US Treasury, that maybe – just maybe – they would be looking for a monetary substitute for the dollar. They have not yet. But we think they will.

So I’m playing what I suspect the readers of Grant’s have come to see as my monetary trombone. Talking once again about gold mining shares and gold. I am discouraged but determined in my bullishness.

I believe that gold will carve out a place for itself in the monetary realm, once people begin to question the doctrines and the confidence and the judgment of our central bankers. Which I expect to happen in about 15 years ago.

They ought to question it and I expect they will.

Erik: Now, I want to ask you about what should be done, as opposed to what is being done, in terms of government policy.

But before we get to that question, I want to touch on a book that you wrote called The Forgotten Depression, regarding the depression of 1920–21. The Fed at that point was about seven years old. And – newsflash – they did not conjure $4 trillion out of thin air. In fact, they did almost nothing.

How did that work out?

Jim: The depression of 1920–21 was a brutal one. Macroeconomic data were not so available then, so we can’t exactly measure it as we do measure things now. But unemployment was certainly in the teens. There was a vicious liquidation of stocks and bonds. Bond prices fell as stock prices fell. The real rate of interest on money markets was certainly in the teens.

And what the Fed did, as you say, was approximately nothing. It, indeed, was a willing accomplice to this liquidation, to the deflation of those two or three years.

The Treasury, for its part, ran a budget surplus. And the consequence of these policies was to (I think) foreshorten the depression rather than to extend it. In any case, what was a very, very difficult period came to an end. Unlike the depression of the ‘30s which lingered, really, into the Second World War.

And in the conclusion of the book I described this depression as the final governmentally un-medicated business cycle downturn of our times. It was the last one in which the government did not actively intervene to suppress interest rates, to do what they have now customarily done.

And, you know, I think the evidence is in the historical record that the depression was tough. It was, for many people, devastating. But it ended in a timely fashion. And the recovery took the form of the proverbially Roaring Twenties.

I wrote it as a kind of advertisement for the price mechanism, for which I have the highest regard. And I’m sad to say that the price mechanism is rather on its back foot these days. But certainly it has served us well throughout history.

Erik: And so the effective conclusion is that the price we’ve paid for intervention is that it’s ten years later and it’s still not clear that we’ve really recovered from anything.

You’ve explained in this interview and in much more detail in the book – which I highly recommend, The Forgotten Depression – you’ve explained that you think it might have been better had the Fed not gotten itself into the business of fixing the price of the world’s most important commodity, which is money itself, through interest rates.

But I want to frame the question differently. Considering that what has happened has happened, here we are with a $4 trillion Fed balance sheet. Now that we’re here, and the mistakes that have been made have been made – I know you’ve said that you don’t want the job that Jay Powell has.

But if you were forced into it, if you had to do it, what would you prescribe? What should the government be doing to get us out of the pickle that they’ve gotten us into?

Jim: Well, if the stipulation is that you have to work within the system as it has come to be – which is a fair thing to propose to somebody. If you had to manage the system we have, rather than to conceive and to implement a new one, how would you do it?

And what I would try to do is I would say, look, the government is no more in the business of rigging markets. We’re out of that business as of now. If the stock market wants to go down, it shall go down. We’re not in the business of stimulating asset prices to goose consumption.

We are no longer in the business, by the way, of propping up banks. We are going to try to give you a currency that is stable in its purchasing power. And we are not going to implement a 2% rate of rise in inflation. We are believers in no inflation.

So what you will hear from us from now on is less. Less. We are not in the micromanaging business. We are not in, indeed, the macroeconomic management business. We are about a stable dollar. That’s it.

Erik: Jim, before we close, my favorite scene in the movie The Big Short is where they have this very elaborate made-for-Hollywood scene. These guys are supposedly in the waiting room of a bank and they find somebody else’s pitch book and discover the opportunity to short subprime.

At the end of the scene, the actor looks in the camera and says: Okay, we did this for the movie, guys. If you want to know the real truth, I learned about this opportunity by reading Grant’s Interest Rate Observer.

And I cracked up.

Jim: That was my favorite part of the movie too. It’s amazing. What a coincidence.

Erik: I thought it was great. Needless to say, I think almost all of our listeners are already familiar with the publication. It’s one of the most famous publications on Wall Street. You had Jim Rogers as your first subscriber.

Jim: He was your first podcast guest too, right?

Erik: He was my first podcast guest and your first newsletter subscriber. We share that in common.

Jim: Jimmy is Number One.

Erik: I hope Jim is listening. Jeff Gundlach has described it – Jeff is the head of DoubleLine, one of the biggest bond guys in the country, in the world – he has described it as the only investment research that he actually pays for.

Before we move on, because we have to pay for it too, Patrick has actually worked out an incredible deal with your office. Tell us a little bit about the publication, what it’s about, for anybody who may actually not be familiar with it already.

Jim: Grant’s is a twice-monthly publication. It deals with a whole variety of things. It’s quite opportunistic in its journalism, as a good hedge fund is opportunistic in seeking out value.

We look for the best and the worst. We look for the best values in the long side and we look for the worst candidates when we’re pitching a short. We are about stocks and bonds and gold and good writing. That’s what we’re about.

And I’ve been doing this for, not quite, but almost 35 years. And, you’ve got to read it. I appreciate that question. It’s a great question to be asked, of course, and I appreciate the great question. I am grateful indeed for the time you have given me to talk about my favorite things, which are the financial markets.

Erik: Well, Jim, I have to tell you, Patrick Ceresna, my producer, really put a fantastic deal together with your staff. You have a policy there of not giving anybody a discount. If Jeff Gundlach has to pay full price, listeners, unfortunately so do you.

But we were actually able to negotiate on that a little bit. Patrick got us 26 issues for the price of 24. That’s two extra free issues. That effectively equates to about an 8.5% or 9% discount.

But the real benefit – and Jim I can’t thank you enough for throwing this in – is an autographed personally signed copy of Jim’s book, The Forgotten Depression, which we just discussed. So I definitely encourage listeners to check it out in your Research Roundup email.

(If you’re not yet registered just go to macrovoices.com and look for the download instructions on our home page.)

We do have a sample issue to give you a sense of the format of the publication. It’s an old one from June, because we can’t send you a new one out of respect for current subscribers. But that gives you a sense of it.

And at $1,295 it’s dirt-cheap as an institutional product. That’s why almost everybody has it. For a retail investor, needless to say, it’s a significant investment. But it’s one of the most respected publications on the Street.

There’s also a pro-rated money-back guarantee. If you don’t like it, you can cancel within 30 days. There’s a no-questions-asked money-back refund that is, however, subject to being pro-rated. Any issues that you actually received, they will charge you for.

And, again, it is one of the most respected publications on Wall Street, the only research that Jeff Gundlach pays for. It’s hard to beat that endorsement.

Jim, we’re going to have to leave it there in the interest of time. Patrick Ceresna and I will be back as MacroVoices continues right here at macrovoices.com.