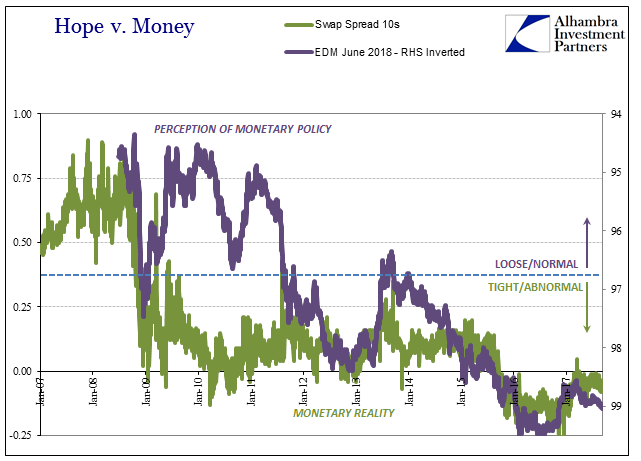

If it wasn’t perfectly clear before, and it really was, there is no way it isn’t now. The Fed is not in any way data dependent. The data on the economy remains in some category of insufficient, longer-term stuck much too far in the direction of atrocious. Yet, the central bank will exit anyway because there is nothing left for them here in the present.

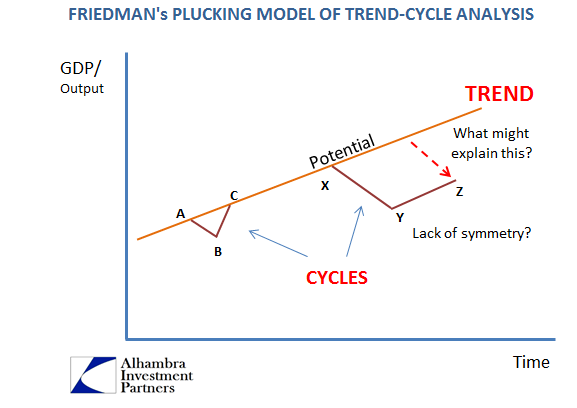

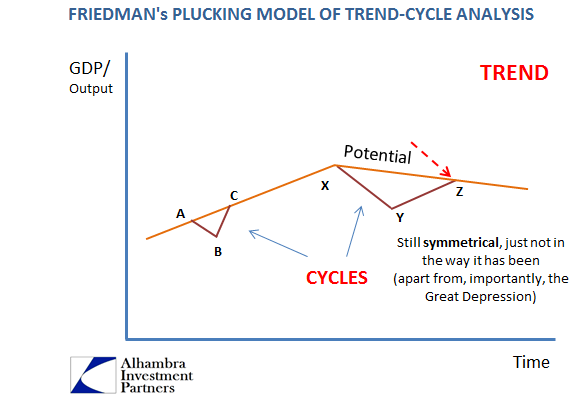

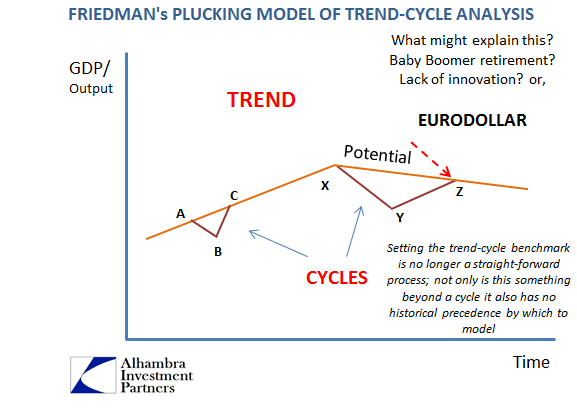

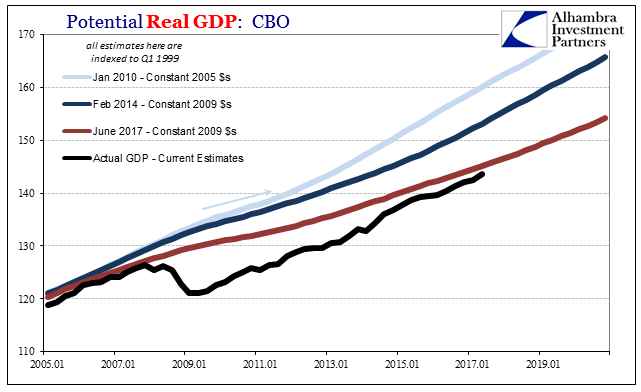

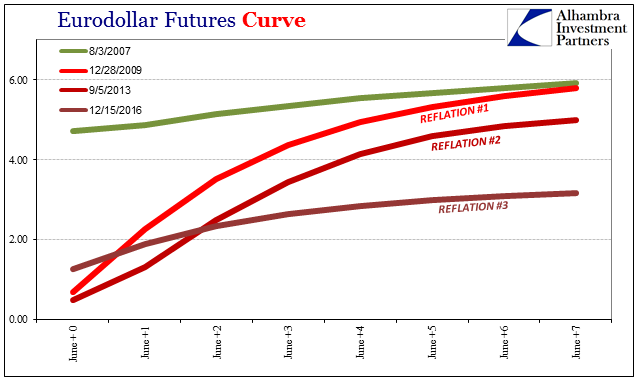

The economy is, in their judgment, what it is. Monetary policy, such that it is, must now turn toward tomorrow. After fighting yesterday’s battles for ten years, and losing, the FOMC knows that time is against it in more ways than one. Even in traditional terms viewing the period after the Great “Recession” as somehow a business cycle, it is already a long one. Recession is inevitable, and there is no longer anything the Fed can do about the last one to make the next one more tolerable.

So they will focus entirely on the next one before the clock strikes zero. That means getting their main interest rate levers back up near as normal as they possibly can, and the balance sheet as close to whatever and however they define neutral in this brave new world without actual growth.

Fed Chairman Yellen today:

It would be up to future policy makers to decide in the event of a severe downturn whether they think it’s appropriate to again resort to balance sheet, to adding assets to a balance sheet. I would say that if economists are correct, that we’re living in a world where the level of neutral interest rates not only in the United States but around the world is likely to be low in the future due to slow productivity growth in demographics. Now, we don’t know that that view will bear out to be correct, but it is a view that many people adhere to when there is evidence of it, then future policy makers will be faced with the question of, in the event of a severe downturn, where they’re not able to provide as much stimulus as they would ideally like by cutting overnight interest rates, what other actions are available to them?

This is, of course, not what most people are expecting of exits and rate hikes. Usually when you lose the last battle you don’t just say “oh well” and move on to the next. Economists at the Fed have no accountability so they can do whatever they wish, including facing the future without any idea what just happened. They have theories, as everyone does, but none that are consistent with the evidence.

Yellen again:

For a number of years, there were very understandable reasons for that shortfall, and they included quite a lot of slack in the labor market, which my judgment would be is largely disappeared. Very large reductions in energy prices, and a large appreciation of the dollar that lowered import prices starting in mid-2014. This year, the shortfall of inflation from 2 percent, when none of those factors is operative is more of a mystery. And I will not say that the committee clearly understands what the causes are of that.

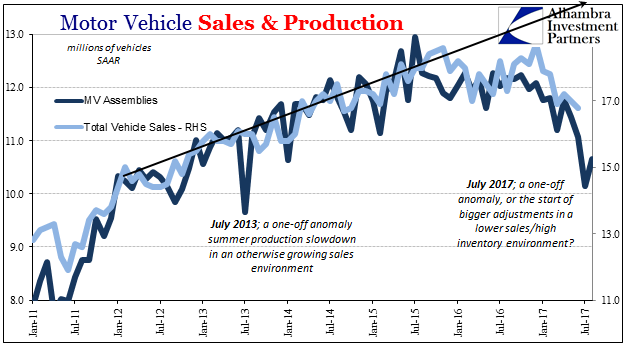

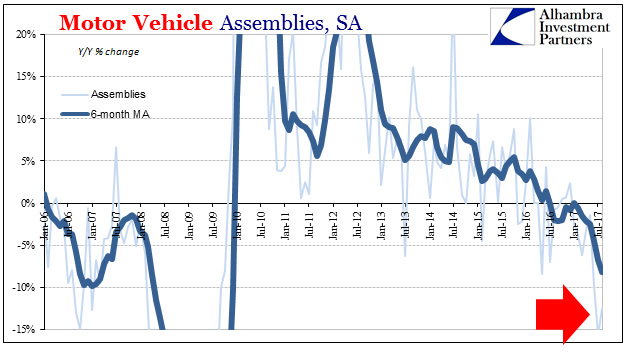

It actually isn’t all that hard to understand clearly. Just yesterday Ford Motor announced that it was furloughing several of its factories in North America, three here in the US and two in Mexico. Normal facility shutdowns happen in July. From the Wall Street Journal:

Ford Motor Co. said Tuesday it will temporarily idle production lines at five North American plants, including three in the U.S., the latest in a series of moves by U.S. auto makers to cope with slowing vehicle sales and rising industry capacity.

Auto sales were until the downturn in 2015-16 one of the two (oil production the other) legitimate bright spots in the otherwise moribund US economy. Sales were truly robust for several years running, so a downturn for the auto sector isn’t unexpected, cyclical as these things are.

What really matters in 2017, however, is that unlike in past periods there isn’t anything else that might pick up the slack, so to speak. In other words, as the one good part of the economy turns to bad, it leaves behind only bad. The economy, as the eurodollar, grows weaker not all at once but in spots and in chunks.

Vehicle production is a big chunk, and its stumble explains a good deal why the upturn following the “transitory” near-recession last year has been so muted – and therefore why inflation isn’t a mystery. When money flows freely through the economy there are rising consumer prices; when the economy cannot flow freely because of liquidity preferences that stymie and strangle it, the result is a central bank that has given up all pretenses.

The global economy is stuck going only in one direction; the wrong one. Yellen is right to be concerned about one thing, though. Maybe the next one will be like the last two (2012, 2015-16) near-recessions but not anything worse. Then again, maybe the next one will be something else. There is no escaping that there will be a next one. The Fed is preparing for it to be a cyclical turn because it never came to terms with the last one not being a cycle (and the reasons why).

It’s another way of writing what I wrote yesterday; none of this monetary policy stuff really matters. What does is:

Stay In Touch