Readers of National Mortgage News will recall that shortly after long-term interest rates hit a peak around Thanksgiving of 2018 (at about 3.25% for the 10-year Treasury note), Federal Open Market Committee Chairman Jay Powell executed a magnificent pirouette, indicating that there would not be any further increases in the target for short-term interest rates. While markets share a common misbelief that the FOMC is now going to lower interest rates, in fact the FOMC is more likely to leave things where they are for the rest of 2019.

That policy has significant implications for holders of mortgage servicing rights, of which there are many. All manner of nontraditional investors have entered the market for MSRs, which have been one of the best-performing fixed-income asset classes over the past five years. Increasing short-term interest rates and other actions by the FOMC over the past decade have driven down lending spreads but also pushed the price of MSRs to all-time highs.

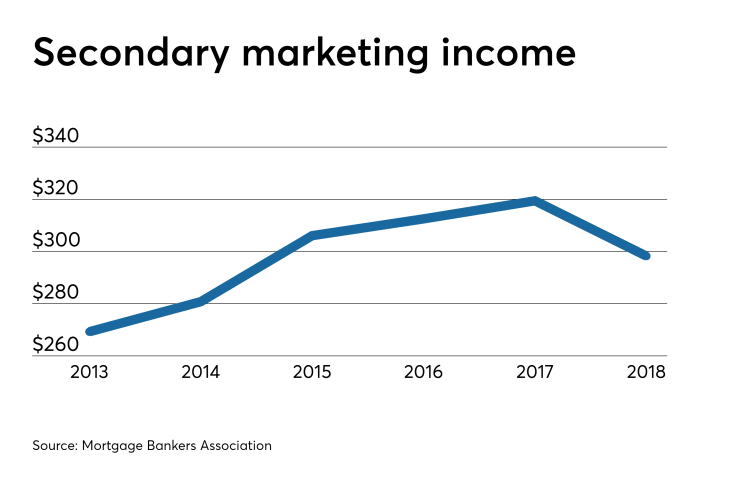

But since last October, new production conventional MSRs have fallen from 4.5-5.5x annual cash flow to 3.5-4.5x annual cash flow depending upon the average loan coupon. Thus while lenders have been making a point or more on MSRs when they sell new loans into the secondary market, investors in servicing assets have seen a decline in pricing. The table below from the survey conducted by the Mortgage Bankers Association shows secondary market pricing for selected residential loans, including the gain on sale for the mortgage note and the premium for the sale of the servicing.

| Secondary Marketing Income | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| Secondary Mktg Gains | 153.04 | 190.58 | 209.35 | 217.92 | 219.91 | 188.92 |

| Capitalized Servicing/Svg Released Premiums | 119.16 | 93.09 | 99.22 | 96.50 | 101.16 | 111.06 |

| Repurchase Reserve Provision | -2.94 | -2.89 | -2.49 | -1.91 | -1.64 | -1.72 |

| Net Secondary Marketing Income | 269.26 | 280.78 | 306.08 | 312.51 | 319.43 | 298.25 |

| Source: MBA's Annual Performance Report; retail and consumer-direct-only companies | ||||||

At 111 basis points for 2018, the servicing released premium data collected by the MBA suggests a 4x multiple for all loan types, a remarkable increase in prices compared with five or 10 years ago. Over the past five years strong investor demand for MSRs has taken prices even higher — to 5-6x annual cash flow for mortgage pools with lower coupons. But since October 2018, as medium- and long-term interest rates have fallen, projected and actual mortgage prepayment assumptions have accelerated, causing the expected average life of MSRs to shorten considerably.

“With the change in rates, modeled prepay speeds and the resulting MSR values have moved accordingly. MSR values from April to May were down consistently (by a ½) multiple,” notes Mark Garland, managing director and head of MSR valuations at MountainView Financial. “While these lower MSR values do reflect the rate environment and expected prepayment speeds, the demand from MSR buyers is still very strong and there is general consensus around MSR values.”

With the decline in interest rates and the related surge in mortgage loan prepayments, nonbank mortgage companies are in a bind. Why? Because their chief capital asset — namely MSRs — are disappearing at an accelerating rate due to prepayments. Each month, as more loans are prepaid when a mortgage is redeemed or refinanced, the MSR owned by mortgage lenders amortizes and shrinks in size. This leaves less capital available for the mortgage firm to use as collateral for bank lines and repurchase agreements. As prepayments increase, lenders must seek to ramp up loan production to keep pace.

When the value of MSRs shrinks, mortgage firms may also be forced to meet margin calls on existing loans and credit facilities as the value of servicing assets pledged as collateral falls. The surge in mortgage prepayments illustrates one of the key risks to nonbank mortgage firms, but also one of the opportunities in terms of making new loans — albeit loans with lower mortgage coupons and also lower prepayment speeds.

Nonbank lenders did not do much better in terms of profitability last year, raising an important question: Can both banks and nonbanks actually make money on mortgage loans and, equally important, keep pace with the amortization on existing MSRs? NMN

Mortgage prepayments are expected to remain at current levels, but some parts of the market are running even faster. In particular, notes Garland, FHA streamline refinances and

Will the runoff of MSRs capitalized at the record price multiples seen in 2018 now leave a hole in the capital of the mortgage finance industry? The results will depend upon the issuer and whether a given lender is focused on recapturing mortgage refinancing and new production as opposed to the co-issue or bulk market for MSR. As has always been the case, the cheapest MSRs are those originated by an efficient lender rather than purchased in the secondary market.

While lower coupons for new production loans does imply a reduction in income from the float, cheaper leverage will also boost returns for leveraged strategies. Pricing levels for new production conventional MSRs with 4% coupons were still near 4.5x cash flow at the end of May, according to MountainView Financial, while higher coupons were trading at a discount due to greater prepayment expectations.

The good news for the MSR market is that investor demand remains high, especially for lower-coupon pools, which have shown low prepayments and strong default experience. The accumulating demand for MSRs from larger buy-side customers suggests that mortgage servicing assets could see a rebound in pricing as and when the dust settles in the Treasury bond market.