It’s like some sort of water torture

Nov 7, 2019

–Yields fell yesterday with tens -5.3 bps to 1.812%, buttressed by a solid auction. Early in the session there was a buyer of 100k TYZ 131c for 3 (settled 4 vs 129-105, OI +40k). Prior to the auction, news of a delay in the US/China agreement sparked short cover buying; open interest in TY fell 22k. This morning interest rate futures have given away yesterday’s gains (and more) as US/China have apparently agreed to a phased decrease in tariffs. It’s like… like… water torture.

–In any case, on the euro$ strip EDU20 through EDU22 settled higher by 3.5 to 4.0 bps, while as of this writing greens are -5.0 to -5.5. Thirty year auction today. Will a yield below 2 3/8% generate strong demand? 30y yield ended yesterday at 2.296%.

–NY Fed’s Williams said yesterday that the Fed would address a recession by cutting rates to zero and using communication and asset purchases. Well, we know that the last item “works” as the Fed’s massive bill buying has juiced stocks and calmed rates. As previously noted, forward calendars on both the ED and FF curves indicate that further outright easing in the form of FF cuts have been pared WAY back. FFF20/FFF21 settled -24 yesterday, indicating exactly one ease over the next calendar year. Cuts aren’t necessary, just keep the ‘not-QE’ coming.

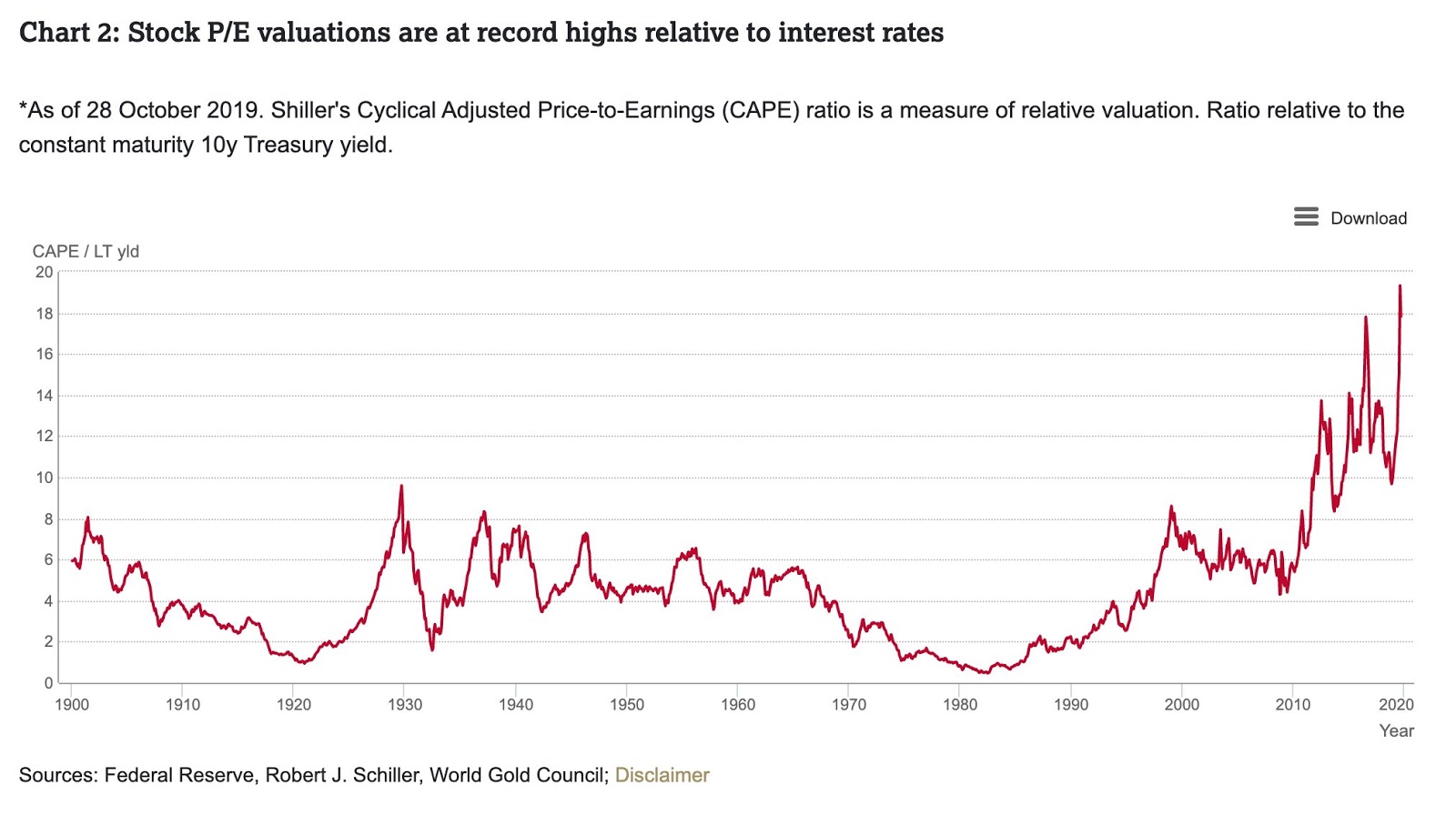

–Kayla Tausche of CNBC reported yesterday that Trump will deliver a speech on trade and economic policy at the Econ Club of NY on Tuesday Nov 12. So we have that to look forward to… (followed by CPI Wednesday, PPI Thurs and Retail Sales on Friday).–Interesting chart below shows that Shiller’s CAPE p/e is at a record high as compared to the ten year yield.

https://jessescrossroadscafe.blogspot.com/2019/11/stocks-and-precious-metals-charts-lions.html