While China’s coronavirus outbreak dominates Western media attention, the Chinese economy has been off for its Golden Week New Year celebrations. Unfortunate timing, to say the least. While global markets have been digesting the latest developments, domestic markets in China have been closed.

Nobody really knows how they will reopen on Monday.

As a consequence, the People’s Bank of China has asked for calm. Standard practice facing a crisis, the central bank has already preannounced that it stands ready with additional liquidity should the need arise. Authorities also appealed for what they believe should be a more “rational” reaction from investors, bankers, maybe even deposit holders alike.

Don’t panic.

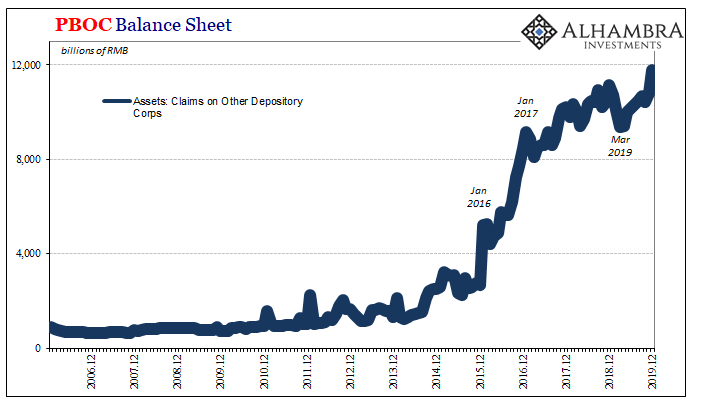

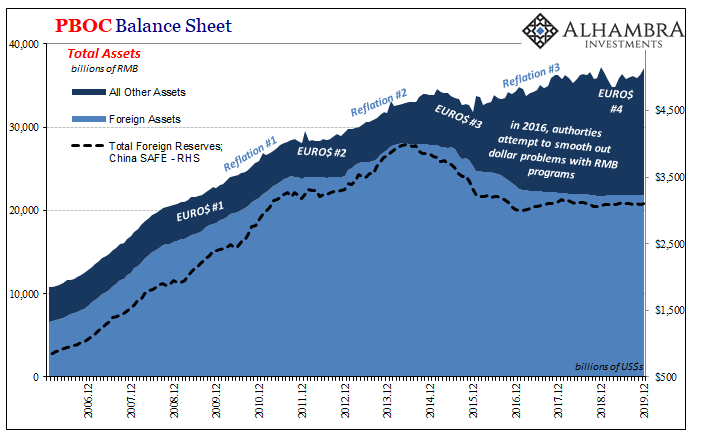

As if monetary life in China wasn’t difficult enough already. Officials had been letting RMB back into the banking system over the last few months of 2019 – long before the coronavirus was first detected and dissected as an investment theme. RRR cuts, rate cuts, neither apparently satisfactory, therefore what the PBOC’s balance sheet records is a little extra insurance on top of those.

These months before, during, and after China’s Spring Festival are always tricky for analysis, so you can only imagine how it must be for these central bankers to operate within them. They have the unenviable job of keeping the entire system liquid enough to withstand an entire weeklong holiday.

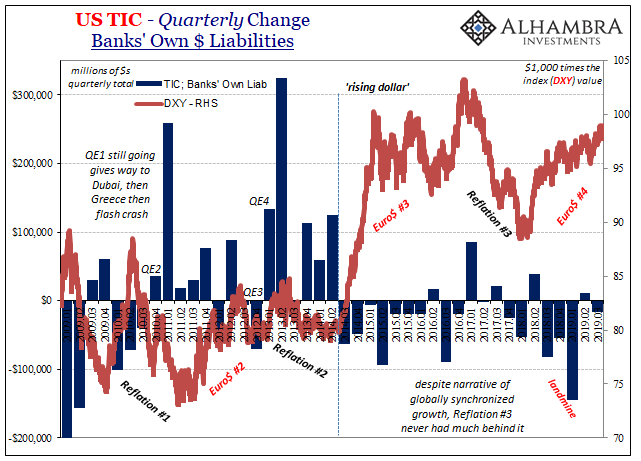

It’s stressful during a normal year. Over the last several years, obviously, Euro$ #4 has added that much more strain. What you see above, along with those modest rate cuts and the latest RRR, effective on January 6, is an abundance of caution.

And let me write it again; that was before the virus hit the tape.

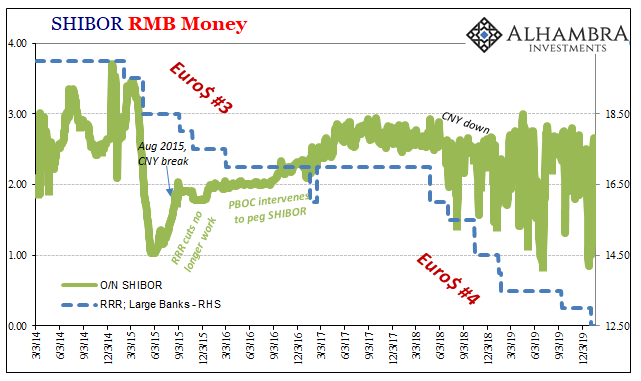

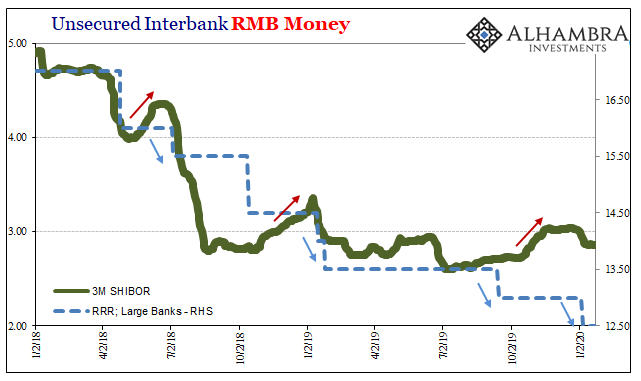

There’s still no accounting for the mess in RMB markets, particularly the main overdraft backstop (overnight). The 3-month SHIBOR rate is higher now than it was at the beginning of last July despite two RRR cuts in between.

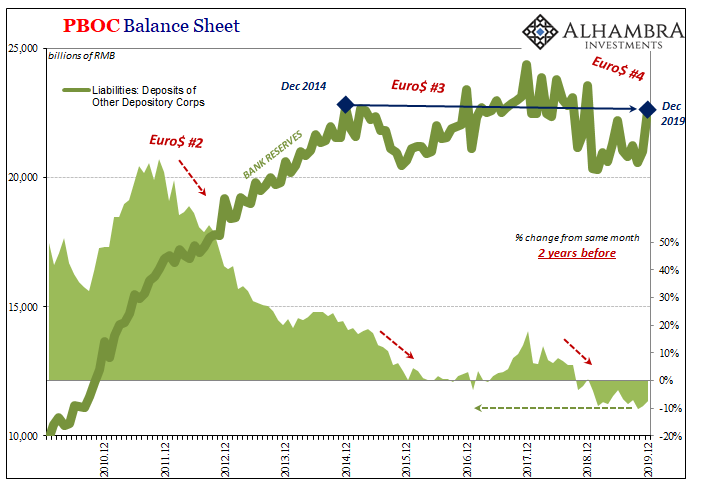

The problem isn’t difficult to identify. The level of bank reserves continues to contract and is at level that should get more people’s attention – if only they ever attempted to understand what’s really going on in China. Most seem to “know” it’s a mess without ever specifying its details and dimensions.

The level of bank reserves, the PBOC liability Deposits of Other Depository Corporations, in December 2019 was just a hair less than the level in December…2014. Half a decade and the same amount of bank reserves. That’s a solid and alarming dimension (as is the correlation with the eurodollar system’s behavior).

That’s why so many RRR cuts, the rationale being the banking system would make up this massive and growing difference. In one sense, they’ve been successful in that China hasn’t yet blown up like a lot of people have been expecting. A mountain of debt and an increasingly dead economy trying to plod through so much waste and overcapacity. Some monetary restrictions on top is a recipe for trouble.

It has been trouble, just more of the slowly squeezed variety which is what counts as success these days. Long gone are those when 8% growth was considered recession. Nowadays, clinging to 6% would be akin to a miracle.

And, once again, that was all before the coronavirus.

The disease is a huge risk the Chinese can ill-afford. Showing up at arguably the worst possible time, it is an economic as well as human infection. The weak economy makes it particularly susceptible.

Thus, quite a lot of this analysis is stale (sorry about that). We know what shape China is in already, and we have a pretty solid idea of how authorities want to play the eurodollar thing, as much as anyone might be able ascertain from these secretive institutions, but we won’t know for weeks maybe months what the pandemic could do change everything around only starting at the central bank.

They were already becoming uncomfortable on the monetary side in November and December. And that includes the usual monkey business with CNY.

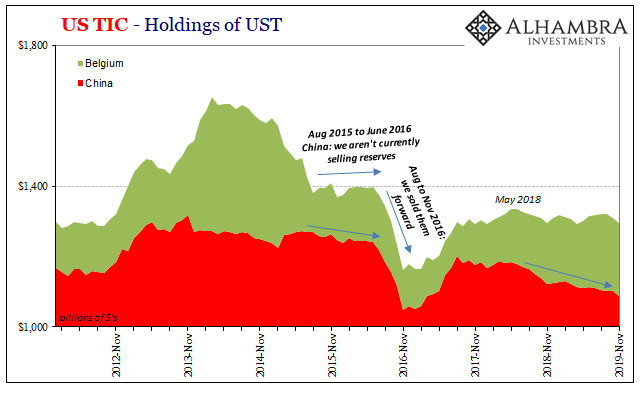

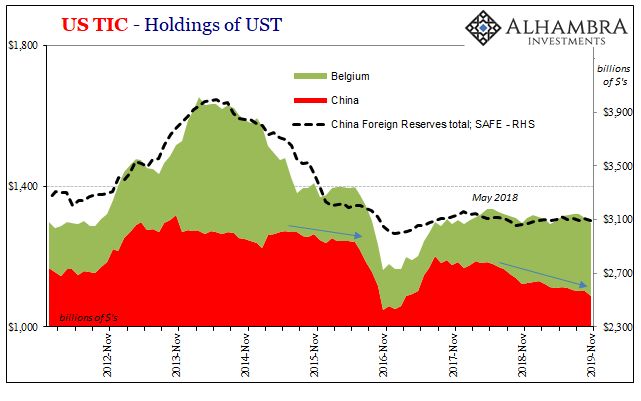

China’s SAFE reports that the country’s official level of foreign reserves, in dollars, has remained remarkably steady over the last several years. That even though from other sources such as TIC in America where the data suggests the Chinese have been “selling UST’s” again (which would explain the increased RMB assets of late to offset them).

According to TIC, mainland China has seen fit to dispose of about $94 billion dating back to the month of May 2018 – when CNY tanked. In November, the latest monthly estimate, the decline accelerated sharply (-$12.4 billion in the one month).

The reason we include Belgium’s holdings of UST assets is clear enough when you overlay China’s SAFE data on top.

Belgium is the home of Euroclear, the big global derivatives (and shadow money) clearinghouse. Without digressing too far into the weeds, “selling UST’s” is indeed more complicated than it may otherwise seem (thus, it deserves the quotation marks). And, for the record, still none of it shows up on China’s IMF filing (Section IV).

In the case of China’s Treasury assets (to say nothing of other kinds of US$ and non-US$ assets), some or maybe all of what’s disappeared has been transferred to Belgium. Why? Likely as collateral for unknown types of FX interventions; the generalized selling forward of these “reserves.”

The same thing, more or less, had happened beginning in last half of 2015, too. It seems the Chinese weren’t too enthusiastic about the eurodollar market’s demands on CNY, something that happened around August of that year. In response, authorites stepped up these kinds of hidden interventions (supplying “dollars”) to try to manage the worst parts of Euro$ #3.

If they are doing the same thing again, and more and more that looks to be the case, then this raises the risks both externally as well as internally (think of what happened in late 2015 and early 2016).

It is another ball the central bank has thrown up in the air which it must juggle alongside all these other domestic ones flying all around. An escalating series of activities and interventions that continue to move in the opposite direction of calm and normal.

Which, one more time, all came before you know what.

Stay In Touch