Making the rounds on Twitter yesterday (h/t to M. Simmons) was a quote attributed to Minneapolis Fed President Neel Kashkari. I can’t find any confirmation for it so it could be one of those fake news tweet situations. And the only reason I include it here is because it sounds like something he would say; the urge to pile on if true.

Back in October, Kashkari had challenged the emerging consensus on September’s repo rumble. He quite rightly began with the right question; why are we doing anything? After all, there’s this thing called the Discount Window (actually Primary Credit) standing by day in and day out.

They don’t want to use it so the New York Fed should have run to comfort them more quickly with a new facility…That’s called the height of entitlement if ever there was one.

However, he doesn’t seem to have considered the other possibility; what if it isn’t entitlement but something more structural that is keeping institutions from obtaining their liquidity needs from the Discount Window and the repo market? Adding that banks are supposed to plan for liquidity, echoing my own take on the event, Minneapolis Neel comes to the opposite conclusion.

Banks do plan for liquidity, and everything about mid-September was known well in advance. To me that says there’s something else going on. To Kashkari, well.

And now they’re complaining because they failed to plan.

What?

Like me, he felt that was too much overreacting to what was, essentially, a dress rehearsal. For weeks and even months many people tried to make a lot out of what wasn’t really a market event. Neel was right about that.

However, that didn’t necessarily mean everything was on the up and up. Hardly. What happened in repo could have reasonably fallen somewhere in between a big nothing and the end of the world. Besides, it’s not the first time something like that had happened which officials like Kashkari had dismissed in the same way.

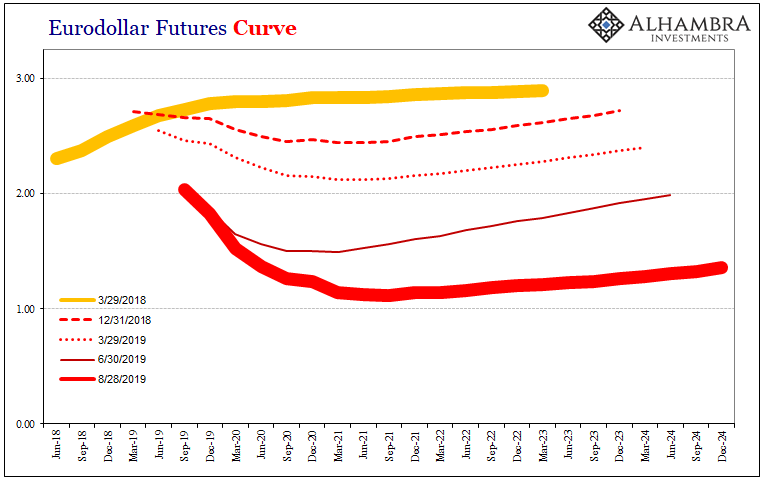

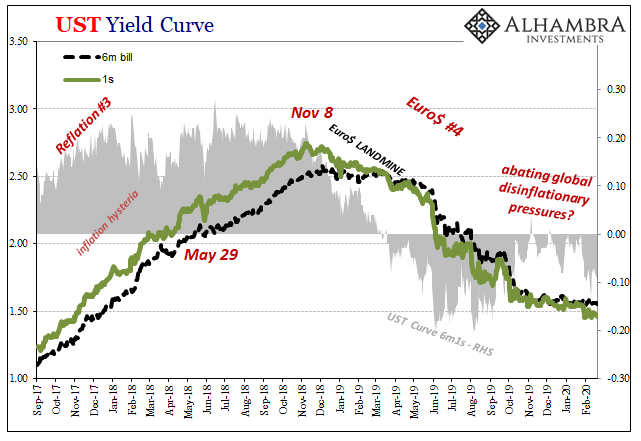

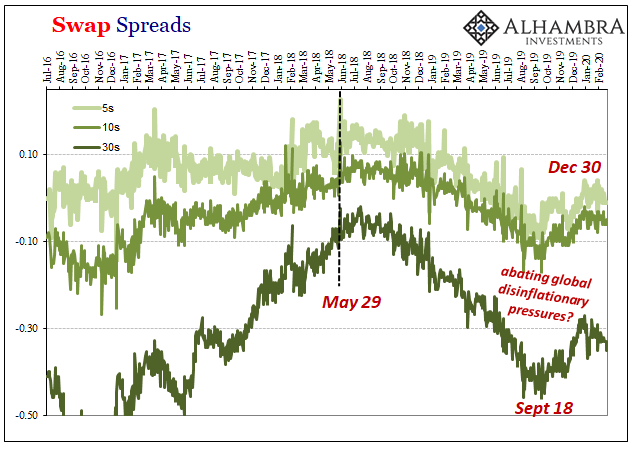

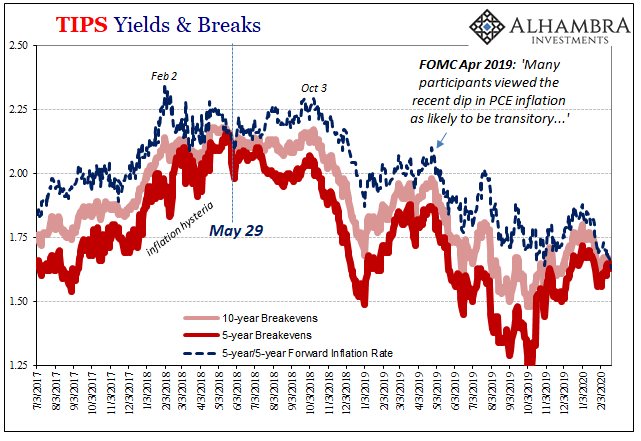

I’m thinking about all those in 2018 – the curve inversions, eurodollar futures first, the dollar not falling, as well as May 29. To think that nothing interesting was going on during trading on May 29, 2018, gets harder to do the more time passes which merely confirms the significance of that date.

What it had meant, and still means even now in 2020, in bond market terms was incredibly simple, some good advice coming out from those who actually work and operate the global monetary system. It wasn’t heeded, or even considered for long, simply because it made monetary authorities very, very uncomfortable over the implications.

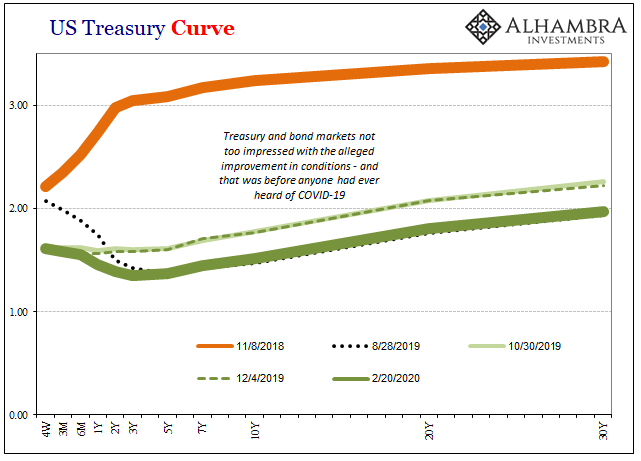

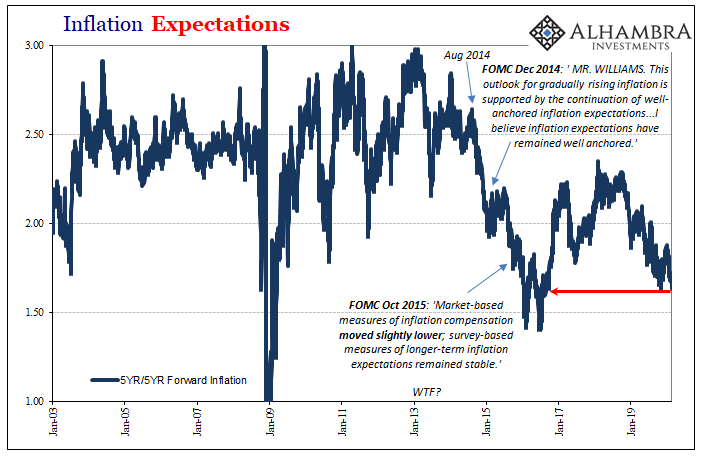

They all said the economy was accelerating, inflation, too, and that would require further rate hikes for the smooth sailing into 2019 and beyond.

The bond market said, point blank, not happening. What May 29 pointed out was that a point of no return may have been reached; beyond it unless policymakers actually did something substantial (rather than ceremonial) the liquidity problems that had developed in the first half of 2018 (rising dollar, for one) would more and more wreck the mainstream forecast.

Globally synchronized growth was already at great risk even at that early juncture (BOOM!!!) of becoming the globally synchronized downturn we observe today. Score another one for the bond market in its fight with central bankers.

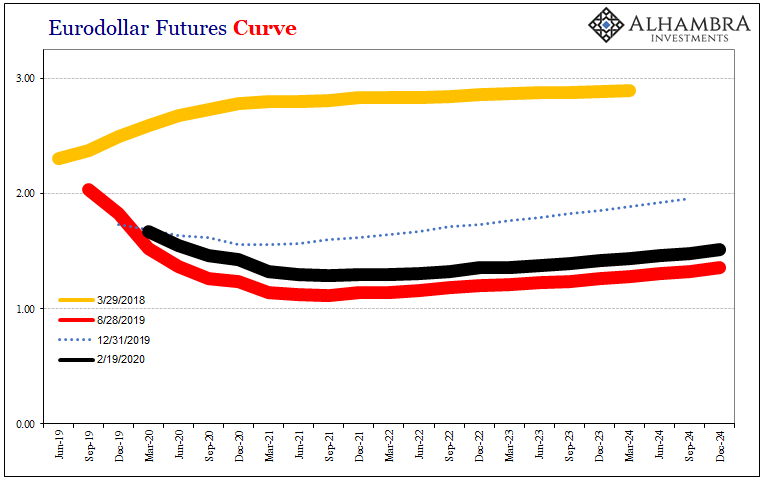

September 2019’s repo disruption was a reminder of the same kind of issues as what were behind May 29, structure dollar problems that span the whole global economy. The Fed chose again more symbolism limited to what it calls repo operations. This despite the fact that more and more they have come to realize at least the correlation between the rising dollar and economic wreckage.

The bond market hasn’t been impressed, thus the state of curves all these months later.

Which brings us to the tweet in question.

KASHKARI: LOW TREASURY YIELDS 'AN EXPRESSION OF CONFIDENCE' BY INVESTORS

— *Walter Bloomberg (@DeItaOne) February 19, 2020

Again, if Neel Kashkari didn’t actually say it, somewhere in the central bank there are any number of academic papers which agree with the sentiment, one that is widely shared throughout the Fed’s ranks.

Alan Greenspan’s series of one-year forwards. The bond market is, for central bankers, merely an extension of their own policies.

One need only glance through the literature to see what I mean. Here’s an example of a widely cited paper from 1999-01 which seeks to better define the yield curve’s behavior…as a function of FOMC announcements and pronouncements (as well as the market seeking to determine ahead of time what those announcements and pronouncements might be).

They believe everything starts with them. Downright Ptolemaic.

The truth is very different. No matter how many times they use any class of linear-quadratic jump-diffusions as state variables, Economists just don’t understand bonds. In fact, the more they try to break down and decompose interest rates and curves the less they seem able to decipher and comprehend; econometrics, as far as bond yields are concerned, is nothing more than a way to justify and reverse engineer contentious and highly contrary signals as being friendly to a predetermined (monetary policy always works) mainstream position.

Because unlike the stock market the bond market figured out a long time ago that central bankers are frauds.

In a final nod to Kashkari’s possible recent statement, if he said it then he’d be right about one thing. Bonds today are indeed very confident – that the next move the Fed makes will be a rate cut more and more likely as the beginning of at least another series of them.

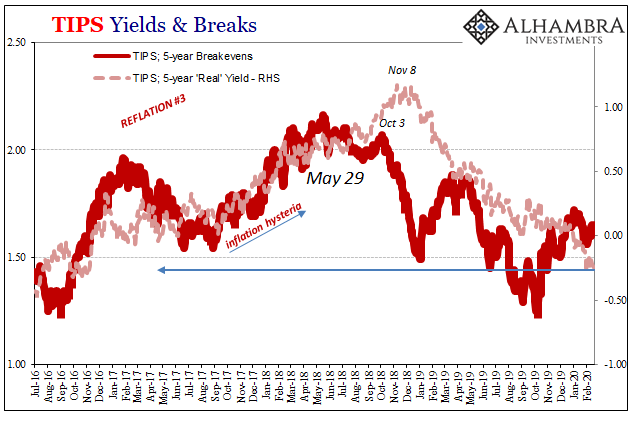

From eurodollar curves to inflation expectations; look at those real yields on TIPS falling to the lowest since 2016.

Every piece of the bond market has turned against the prevailing view that the US or global economy is getting better. Long before the coronavirus, the actual evidence is piling up for the opposite case. Just like in 2018.

Stay In Touch