Tomorrow represents the 6-month mark for the Treasury market. On August 4, 2020, nominal benchmark 10-year yields declined to their absolute closing lows. Over the half-year since, rates have generally been on the rise which should be a long enough period by which to categorize our interpretations of what it all means.

Most mainstream commentary places any upward trend (of any duration) into the category of BOND ROUT!!!! Much of that stems from an often-purposeful mischaracterization; compared to the most extreme levels, such as those on August 4, the trend at least is consistent with the narrative.

While true, more context comparing the current half-year period with prior reflationary intervals produces a whole series of unanswered questions. Forget the inflationary monster that lives between the lines of mainstream reports and analysis, can we even call this reflation? Going through the various dimensions, the last 6 months have stayed closer to an uninteresting market fluctuation than perking up well past reflation into inflationary dangers allegedly just ahead.

That it is even questionable in any parameter – let alone most of them – is why I’ll keep calling this Inflation Hysteria #2. If you can’t even match up favorably to Inflation Hysteria #1, then the situation must be something altogether different.

First, though, we want to define our terms. We hold to slight differences in terminology which can lead to various other implications of our own definitions. This can be confusing, especially for those who are new to the eurodollar framework for interpreting the monetary and financial world (and therefore better assessing the wider economic as well as social and political situation).

We start with the position that the first Global Financial Crisis (GFC1) and its Great “Recession” neither were one-off, temporary emergencies; meaning it hadn’t been a recession at all. The primary and proximate reason became clear all the way back on August 9, 2007, when the global reserve currency system (eurodollar, not dollar) categorically changed to become so impaired to the point of then remaining unfixable (and unmanageable).

This didn’t mean constant, deep negatives, an unbroken contraction or persistent deflationary force degrading market and economic functions in a straight line forever downward. Rather, the broken-down system has been capable of partially restoring itself from time to time. This has created an intermittent, repeating cycle between spasm and relaxation; between the acute phase of an amplified global dollar squeeze, or shortage, and the reflation, or less acute phase, which always comes up (well) short of recovery.

And each time the mainstream analysis unaware of shadow money mistakes for recovery. Every time.

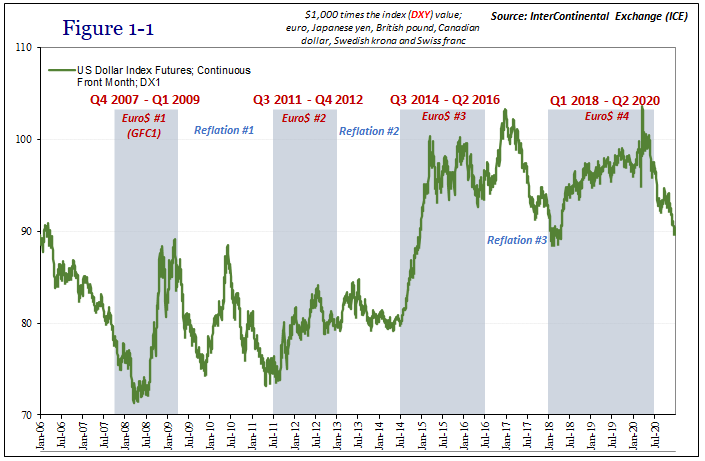

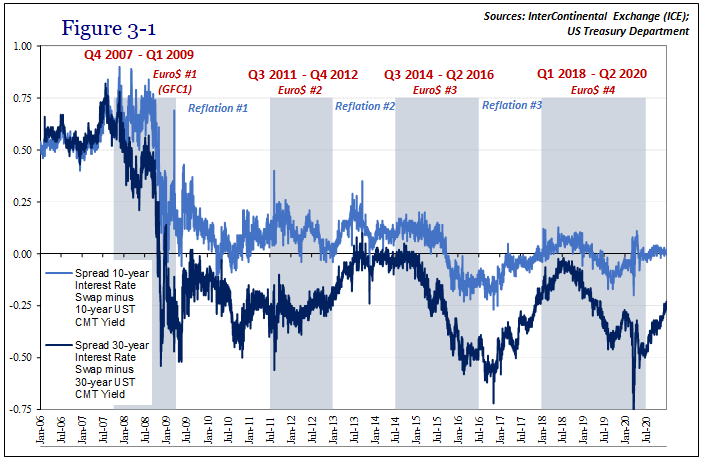

The first of those acute shortages is what we know as GFC1. This Euro$ #1 began on August 9, 2007, and continued to ravage the global eurodollar system (not uniformly) until March 2009. A second acute phase began in Q2 2011, Euro$ #2, while in between what was supposed to have been recovery was plagued by near constant warning signs that the monetary system wasn’t recovering.

Thus, only Reflation #1.

Beyond the end of Euro$ #2, around the beginning months of 2013, the acute shortage phase gave way to reflation followed disappointingly by an Asian-centered Euro$ #3. By the middle of 2016, Reflation #3 (emphasized as “globally synchronized growth”) predictably followed instead by Euro$ #4 (blamed belatedly and wrongly on “trade wars” sentiment).

Acute shortage, relaxation. Rinse. Repeat. No escaping, therefore none of the inflationary and growth acceleration everyone has been looking for because those were the promises “money printing” central bankers kept making.

While it might seem that the primary identifying factor leading our interpretation of these cycles is the dollar and its overall exchange value, we appeal instead to a broader survey of financial and monetary parameters.

The eurodollar system, this global reserve currency, most of it exists outside our direct observation; and, at times given some of its wild, complicated nature, outside of even indirect observation. This sort of shadow money therefore requires a whole lot of detective work in order to piece together an internally consistent picture of what is likely taking place across enough of this broad shadow money world (and it is broad, qualitatively as well as quantitatively).

Like physicists once did when trying to prove the existence of quarks too impenetrably tiny to directly observe, here we are attempting the same kind of endeavor only here for the unfathomably large:

The quark was indirectly confirmed by its effects on other particles, evidence obtained in monstrous experiments to observe not the thing itself but what that thing does, predictably, to other things.

There is no such thing as a eurodollar. There used to be in the form of actual cash deposits of US dollars sitting within the vaulted casings of banks scattered throughout Europe, the Caribbean, and elsewhere outside the United States. Along the way, chains of liabilities were created without the need for actual dollars, though they were called that anyway. So long as one bank accepts the liability of another denominated as a dollar, voila, eurodollar.

So, we can’t and don’t “measure” the eurodollar itself (how would one even do so?), we merely observe the way in which that system affects parts of it, or outputs from it, that we can observe; parameters like interest rates, deep financial pricings like interest rate swaps, and, yes, even the dollar’s exchange value.

For a more thorough reasoning behind these inclusions, you can read the complete arguments and explanations here. Below is a sampling of the updated charts (through the end of last year) showing how the hidden eurodollar conditions produce the evident products of these cycles between acute shortage and reflation:

There is no perfect dating schematic nor is everything neatly uniform; therefore, our desire to find consensus given considerable gray areas for interpretations. Our dates presented here are not meant to convey close precision, just to set out the general outlines for what is itself a consistent phenomenon.

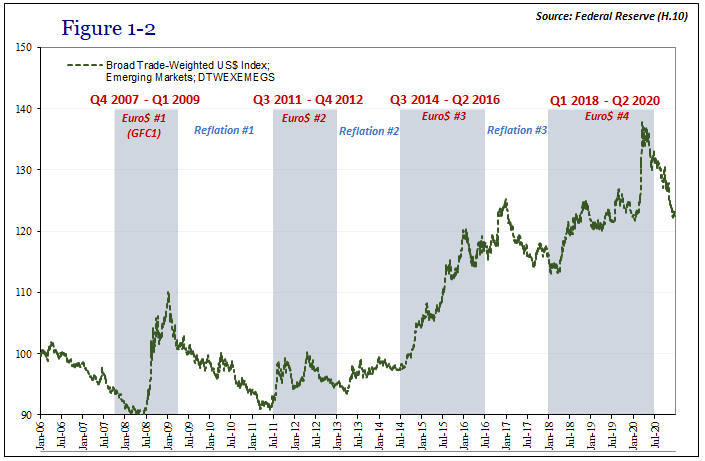

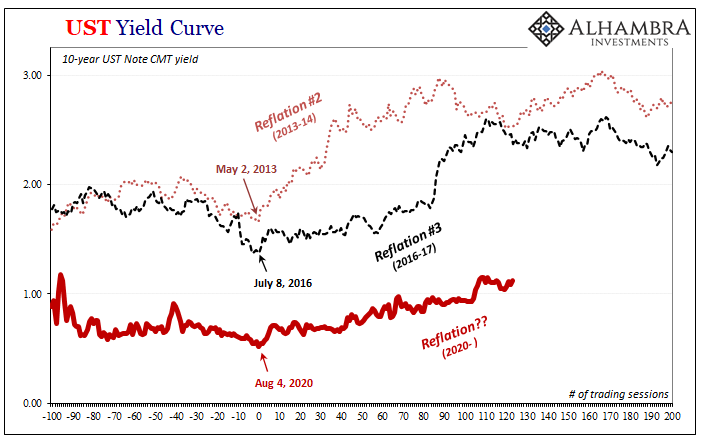

From this framework, we can then compare the current potential cycle (the last six months since August 4) to past reflationary periods in order to hopefully get an honest (not hysterical) sense of where things generally stand. Starting with these six months of rising nominal interest rates:

While characterized in the mainstream as a clear-cut signal of overflowing inflationary excesses, and bank CEO’s who wouldn’t touch these with a 10-foot pole, by comparing the last half-year to prior reflations we find instead a distinct lack of even minimal qualification. Those other two both featured far more significant increases in nominal yields; 2020-21 so far begins at a much lower level and has only fallen further behind as time passes.

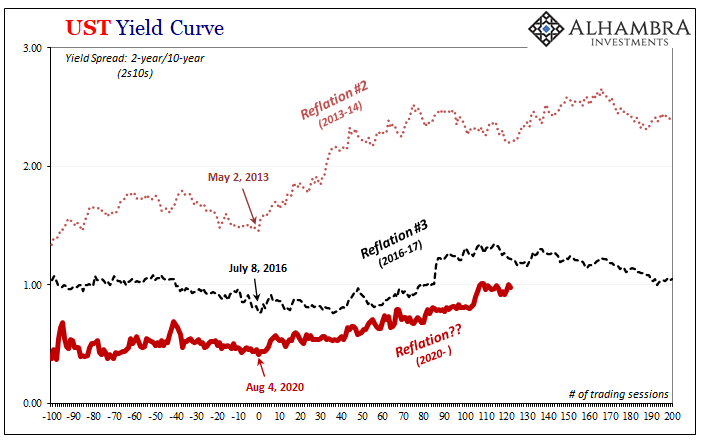

The same goes for the yield curve shape. The term spread between the 2-year note yield and its 10-year counterpart, for example, has increased since last August – and, once again, this has been characterized (steepening) as a significant sign of inflationary pressures building up.

In context, not at all:

According to the curve shape at the same point in each prior reflationary track, the steepening in this part of the curve (and others) doesn’t even come up to Reflation #3’s lackluster levels.

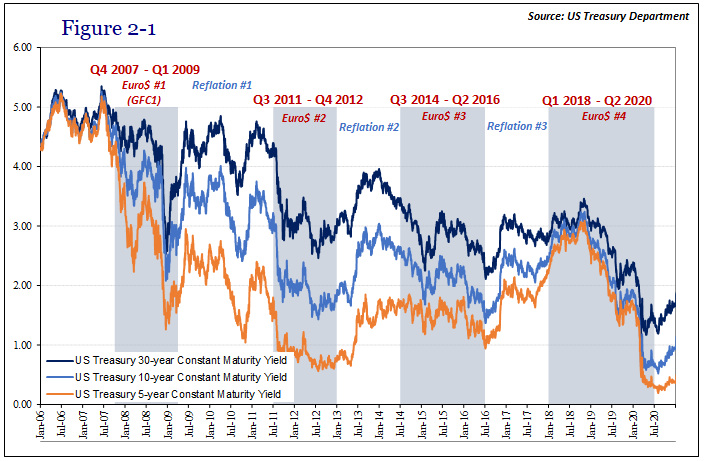

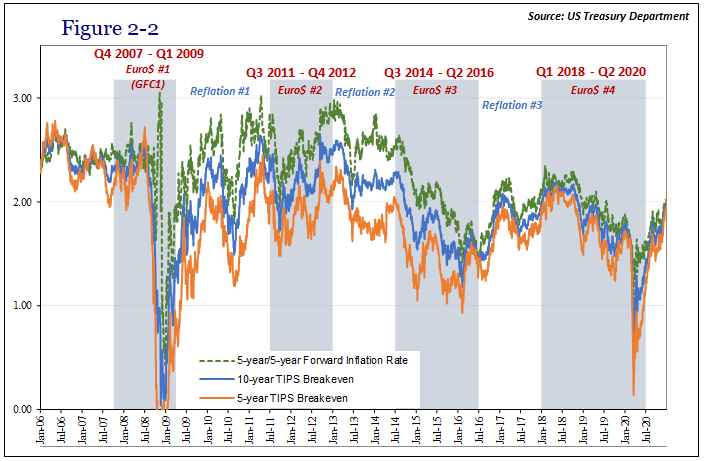

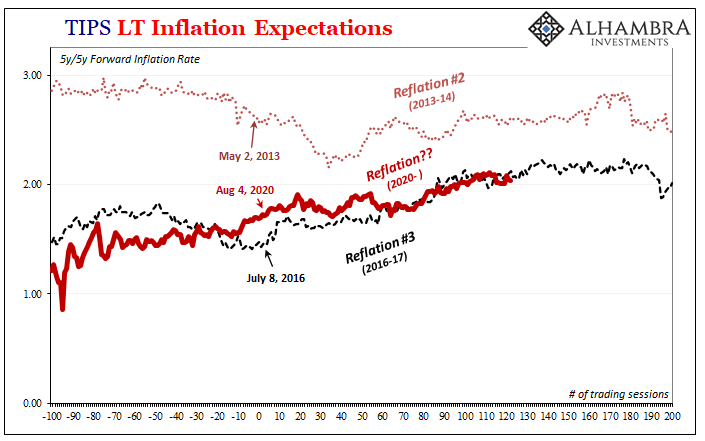

Now long-term inflation expectations (5-year/5-year forward inflation rate derived from the differences between 5-year TIPS breakeven levels and those of the 10-year TIPS breakevens):

Inflation expectations have increased, and this where the inflation hysteria has been most intense. Though rising, hardly in a way that suggests an unusually “flooded” economy rapidly shifting toward the out-of-control. On the contrary, at best they are only one parameter in the same vicinity with the weakest of any of the reflationary periods.

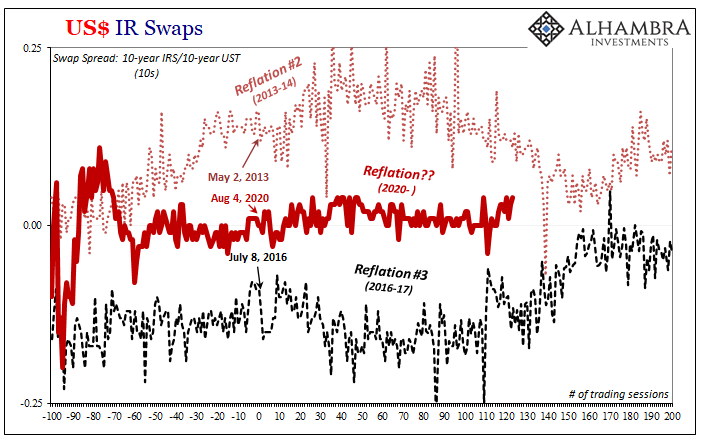

Swap spreads (10s):

Hovering around the zero level at the 10-year tenor, swap spreads don’t suggest anything out of line, more that’s not reflationary than anything (lack of any significant decompression; even Reflation #3 achieved this if later in the cycle).

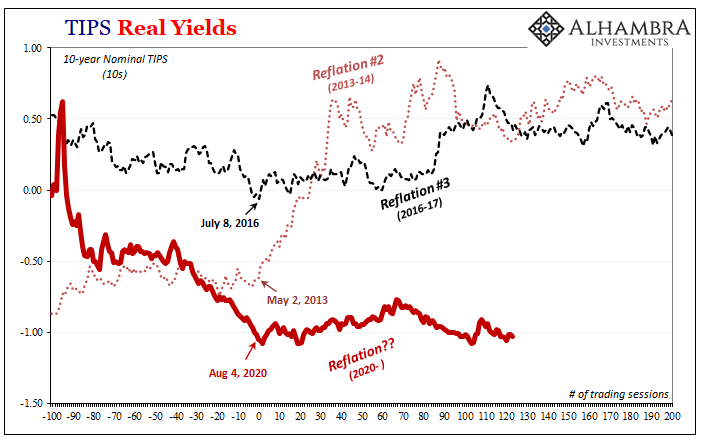

The one parameter which does indicate highly unusual behind-the-scenes perceptions about the last six months, what potentially should be this Reflation #4, is a serious element way down on the opposite side:

In each prior reflationary case, “real” TIPS yields have gained as the shadow money and financial marketplace trades the more relaxed rather than acute eurodollar situation. Since last August, however, real yields have remained low and in some maturities have kept on setting new record lows.

In other words, if we don’t find even inconsistent reflation in our shadow money indications, we’re forced to concede a very different assessment from what the consensus has become. And that includes all the positives which have lined up in the favor of more forceful positivity: from vaccines, or at least their future promise, to massive “stimulus”, or at least in how it could theoretically produce different results in 2021 from what it clearly hadn’t produced in 2020.

What we are looking for continues to be widespread, solid signals of the global system finally surmounting thirteen and a half years of being broken down; for the shadow money system to tell us in clear, unambiguous terms that the world has become meaningfully, categorically different. A clear end to these cycles. We can’t even get unambiguous reflation positions even after six full months materially less than Reflation #3 (the weakest of the bunch, thus the most hysterically overhyped).

Interest rates have risen, in general, for half a year now. That trend looks like it could continue (from a long end perspective; short end, maybe different). What that means, all that means is, interest rates have risen comparatively little even after six solid months. If we’re having this much trouble even classifying the system as Reflation #4, what comes next is highly unlikely to be Inflationary Recovery #1.

Demanding and insisting that it can only be otherwise is just more of the same (hysteria).

Stay In Touch