The Western economic system is deeply flawed with countries such as the U.S. and Britain contributing to the lowest quality economic recovery the world has ever seen, Chris Watling, chief executive of Longview Economics, told CNBC on Friday.

"The economic model is deeply flawed and the system in the west is deeply flawed, particularly in the English speaking part of the world and it needs to change," Watling said.

"I think this is undoubtedly the lowest quality economic recovery we have seen globally… full stop," he added.

The Longview Economics CEO explained that a debt-laden global economy could be vulnerable to looming interest rate hikes.

'Zombie companies' have doubled

The Federal Reserve is on a course to gradually increase interest rates, with financial markets expecting it to approve one more rate hike this year. In addition, other central banks are pulling the reins on bond-buying and other liquidity programs aimed at injecting cash into their respective economies.

"This is a world that is more indebted than it was before the global financial crisis in 2007, there's no productivity growth, asset prices are very elevated, a lot of debt that corporates have built up has gone to share buy backs (and) the number of 'zombie companies' has doubled since 2007," Longview Economics' CEO explained.

In the U.S. alone, households have $14.9 trillion in debt while businesses owe $13.7 trillion, according to the Federal Reserve.

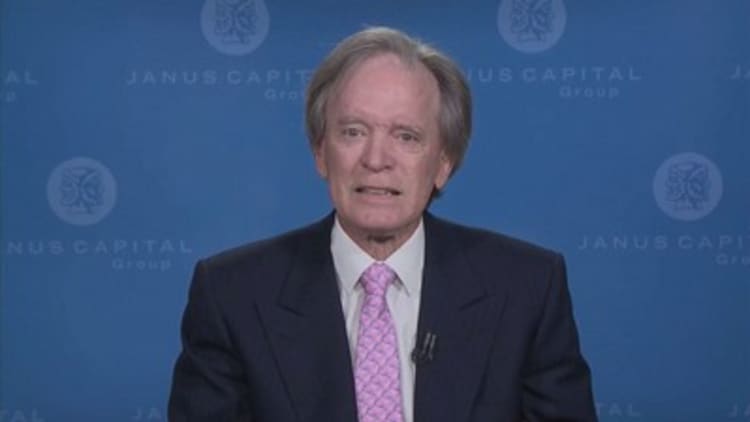

What does Bill Gross think?

Bond guru Bill Gross also warned that the course of global central banks toward tightening policy could be detrimental for the economic recovery. He argued that raising interest rates would increase the cost of short-term debt that corporations and individuals currently hold.

When asked whether an imperfect system constituted a clear and present danger for the financial markets, Watling replied, "Whatever you want to call it doesn't really matter but these sorts of things always unwind when you tighten money. The problem is judging what is tight? And that is sort of the million dollar question."

— CNBC's Jeff Cox contributed to this report.