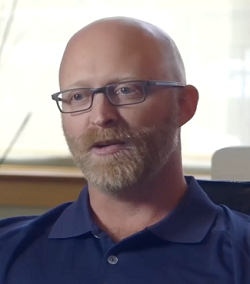

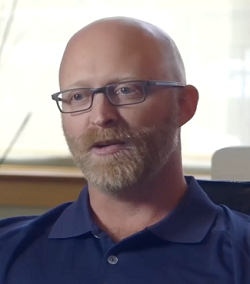

Erik Townsend and Patrick Ceresna welcome Jesse Felder to MacroVoices. Erik and Jesse discuss:

- Is COVID-19 the catalyst that changed the direction in the market?

- FED stimulus – how long will this bounce last?

- How much downside is expected in order to take excess buying out of the market

- Upside in the market caused by central bank response – what happens next?

- Will inflation return in the near future and what are its systemic risks

- Asset allocation strategy to accommodate the return of inflation

- Current buying opportunities in value investing

Download the podcast transcript: [Click Here]

We strongly recommend that you download the chart book that accompanies this episode, as Erik and Patrick will refer to it throughout postgame. If you are already registered at MacroVoices.com, just login and the download link will appear here once you're logged in. If you haven’t already registered, click the red “Subscribe for FREE” button on the top right side of the home page, and register. Once logged in, you will see the download link(s) and will be able to download the PDF document(s).

Click here to register for access to supporting materials.

Jesse has been managing money for over 20 years. He began his professional career at Bear, Stearns & Co. and later co-founded a multi-billion-dollar hedge fund firm headquartered in Santa Monica, California. Since moving to Bend, Oregon in 2000 and founding The Felder Report shortly thereafter his writing and research has been featured in major publications and websites like The Wall Street Journal, Barron's, Yahoo!Finance, Business Insider, RealVision, Investing.com and more. Jesse also hosts and produces the Superinvestors and the Art of Worldly Wisdom podcast.