Macro Voices Podcasts

Subcategories

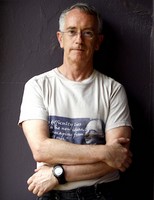

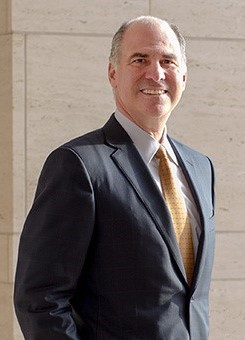

MACRO VOICES is presented for informational and entertainment purposes only. The information presented in MACRO VOICES should NOT be construed as investment advice. Always consult a licensed investment professional before making important investment decisions. The opinions expressed on MACRO VOICES are those of the participants. MACRO VOICES, its producers, and hosts Erik Townsend and Patrick Ceresna shall NOT be liable for losses resulting from investment decisions based on information or viewpoints presented on MACRO VOICES.